Introducing EZBC, Franklin Bitcoin ETF. The simple, convenient way for investors to access the crypto market.

I am cutting out a lot of the things that used to take my energy away. And as I gradually cut them out of my life, I am surprised to find how little I miss them. Tequila is one of those things. Normally, I am the life of the party and I have had all sorts of social and business reasons to be drinking reposados (Clase Azul) and añejos (Don Julio) and ultra-aged añejos (Grand Mayan) with my friends, colleagues, partners, employees or, to be honest, whoever was down.

I haven’t had a glass of tequila - añejo or otherwise - since the middle of November. I wasn’t counting, I just realized it. It’s been three months. Don’t miss it. Same way I don’t miss Twitter. Same way I don’t miss a lot of things I thought were once a permanent part of my regular routine and now are just, well, part of my past. Byeeeeee!

Less time spent drinking tequila, eating badly during and afterward and then sleeping it off the next morning. More time for everything else. Feels amazing. I have reclaimed so much time. And the reclaimed time is quality time because I’m alert and revitalized.

Energy conservation is going to be key for me as I rise up to take on the opportunities ahead. One of the biggest opportunities I see is the tidal wave of potential clients who will be coming to us as they hit the point in their lifecycle where professional financial, insurance, tax and estate advice become not just nice to have but essential.

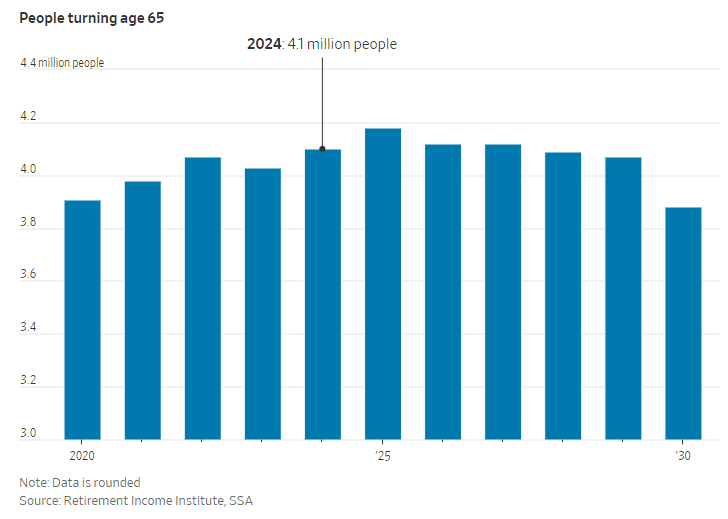

Check this out:

That’s from Ben Carlson’s new post at A Wealth Of Common Sense.

Basically, this year and every single year for the rest of this decade, 4 million Americans will be turning 65 years old. Some of those 4 million people will already have a financial advisor but will be looking to upgrade from the guy at the bank they play golf with to a true independent fiduciary advisor. Some will have never worked with an advisor before because they had the whole accumulation phase part down pat without any need for coaching or encouragement. Either way, we’re talking about a lot of money in motion, a lot of new planning and investing work and a lot of demand.

We’re going to get slammed with demand and it’s my job to make sure we can apply our quality control and meet that demand with our best foot forward. My job is to make sure the firm is ready, willing and able to help. We need to be adequately staffed with the very best financial planning, trading, service and subject matter expert talent I can assemble. We’re sixty people now which will not be enough, no matter how much we leverage the cutting edge technology that’s also coming down the pike. It’s going to take increased investment in both human capital and software to truly make the most out of all that lies ahead of us.

If you’re not talking to us about your portfolio and plan right now, who are you talking to?

Are you missing anything?

Just asking.

I had an awesome conversation yesterday with Joe Duran, founder of Rise Capital and the man who built and sold United Capital to Goldman Sachs. Joe calls himself “an exponential thinker” and his mind immediately goes toward “This is good but what if we could make it great?” I fucking love people with that mindset.

Joe and I in Scottsdale, AZ back in 2019

But in order to follow through on exponential thinking, you have to have the time and the capacity in your life. You have to have the energy. That’s where my head is at right now. Pure energy and a burning desire to allocate it correctly.

So to the Mexican state of Jalisco and all my old favorite agave growers and distillers, lo siento, I’m gonna have to raincheck y’all for a little while.

Ask The Compound

I had so much fun talking with my colleagues Ben and Duncan about the coming wave of retirees and other related topics on their show, Ask The Compound, this week. You can watch it below!

ATC video embed:

The Magnificent 7 is a Bubble

Rich Bernstein was the chief strategist at Merrill Lynch (back when Merrill Lynch was MERRILL LYNCH) from 2002 through the summer of 2009. He earned the trust of thousands of financial advisors and their clients during that time and became one of the most respected market commentators on Wall Street. I’ve been a big fan of his for as long as I can remember and, to this day, I read all his stuff as soon as it hits my inbox.

This weekend’s brand new episode of The Compound and Friends features none other than the famed Rich Bernstein - live from our studio for the first time! And Rich came with something out of consensus to say: Yes, the Magnificent 7 theme is a bubble.

Now, he doesn’t mean “bubble” in the sense that a crash is coming, just that investors allocating dollars today ought to be buying anything but those particular stocks. Rich is known mostly as a Growth At a Reasonable Price (GARP) investor and the portfolios he oversees tend to be globally-oriented with an emphasis on buying reasonably valued things.

You can learn a lot from Rich, as I have. Listen below or any podcast platform now…

Apple:

Find the show on Spotify, Google and everywhere else here:

Andrew Dice Clay

Last night I saw Andrew Clay at Carnegie Hall, which no one would have believed would be possible a few decades ago. You wouldn’t even say the words “Dice” and “Carnegie Hall” in the same sentence. But there we all were. He was incredible. Only one threesome of young women grabbed their coats and stormed out in disgust. Everyone else - male, female, black, white, old, young - were in on the joke and having a great time. We cheered, we screamed, we applauded, we wiped tears from our eyes and we appreciated the fact that we’re all here together for a short time, enduring so much, that the only rational response to it all is to find a way to laugh.

Dice gets this. Three failed marriages and one of the all-time career rollercoasters - from playing Madison Square Garden to disappearing into obscurity to starring opposite Bradley Cooper and Lady Gaga in an Oscar-worthy film to playing comedy clubs all over the world.

He’s been on the throne and he’s been humbled, hated and beloved, red hot and ice cold and everything in between. Watching him get his just due at one of the most famous performance venues on earth last night was really cool and a great reminder that no matter how fast the time goes, we’re still in a marathon.

I’s not over until you let it be over.