I’m a former stockbroker with no formal education in economics or econometrics (the latter word, I couldn’t tell you what it means with a dictionary in my hand). I don’t know anything. I started in this business cold-calling Dun & Bradstreet index cards with the names and phone numbers of business owners. I’m an alumni of the speculative fever swamps of Stockbrokerland in Syosset, Long Island. No pedigree. Classically trained with a plastic black telephone, a headset and an Acer monitor running Quotron.

But, like most of you, I have my own two eyes and two ears to try to understand what’s going on. These have been valuable if we’ve learned how to use them.

Pragmatism and lived experience are significantly more helpful these days than anything else. If you spend most of your time around people who are in the top half of the wealth distribution, you’re not making recession calls. There’s simply no sign of one and there hasn’t been since the start of 2023.

This is because one of the most interesting byproducts of the historic rate-hiking cycle the Federal Reserve embarked upon - and the subsequent “high for longer” period - has produced an unexpected result: Easy money. Never before in the last fifteen years have so many people been able to earn so much - virtually risk-free - in their bank and brokerage accounts. We’re talking about trillions of dollars in income and it keeps on coming. Combine this with record high stock prices and a boom in AI-related IT spending, plus pandemic-era stimulus programs kicking in and you get to where we are in 2024.

Anyone who wants a job can have a job. Wages are still rising in most industries. Home prices are holding. People are still shopping.

In 2022, CFOs at large corporations were certain that the confluence of inflationary pressures and the normal ebbs and flows of the economic cycle would bring about recession. According to the Duke University survey, they were nearly unanimous in this mindset. They prepared for it. Earnings growth went negative for multiple quarters as a result. And then, something totally outside of the formulas of the formally trained economists took place - high rates of income prolonged the expansion.

It wasn’t supposed to happen that way.

The overnight rate on money, it turns out, wasn’t as important as it had historically been. The inverted yield curve didn’t cause the cessation in lending it was supposed to have. Blame it on the fortress balance sheets of the nation’s largest banks, even as the midsized banks were stumbling last spring. Blame it on the renaissance in private credit, with capital on offer to any enterprise that spoke up to ask for it. Blame it on buoyant stock prices and the ocean of unspent cash at private equity funds just waiting to pounce on any and every opportunity. There are a lot of factors at play that simply were not in the models.

I have been speaking emphatically about the preeminence of the wealth effect for fifteen years. The stock market drives investment decisions at the largest companies and it fuels consumer spending, which is 70% of the economy. Even 401(k) balances, which cannot be touched, have an effect on the way people feel and therefore drive household decision-making and budgeting.

There is a growing recognition that record high interest income is working counter to the Fed's goals of slowing down demand. Very intelligent people were ridiculing this idea last year. Now it’s becoming a mainstream point of view. Rick Rieder is the head of fixed income at BlackRock, the world’s largest asset manager. If anyone is in a position to see what’s going on, surely it would be Rick. Rick confirms what I’ve been saying.

Randall Forsyth used his column in Barron’s this weekend to comment on the subject, citing the latest government data:

American households’ net worth jumped by $5.1 trillion, or 3.3%, in the first quarter, according to the latest data released by the Fed on Friday.

More than half of that gain was accounted for by their increase in equities and mutual fund holdings.

And they earned an annualized $3.7 trillion from interest and dividends in the first quarter, up roughly $770 billion from four years earlier

My father-in-law Harry, a CPA, explained to me that older wealthy people in the early 1980’s absolutely loved high interest rates. Their bank accounts bulged with interest, igniting their ability to live large and spend. Brokers at that time were selling CDs and bonds with obscenely high rates of interest to an insatiable audience of well-to-do buyers.

It’s not an accident that the television show ‘Lifestyles of the Rich and Famous” was conceived during this time in America coinciding with the highest interest rates on record: The federal funds rate was 20% (!) in 1980, staying in the mid-to-high teens throughout the period ending in 1982. Wealthy old guys without mortgages or, frankly, a care in the world saw their money compound at incredible rates. In 1984, Robin Leach hit the airwaves for the first time showing TV audiences the unparalleled wealth and success that had been attained by this select group of people. The supercilious tone of his narration and his distinctively British accent became a soundtrack of sorts to the earliest stages of the secular bull market that would run for another 16 years.

Remember this?

My post at the top of a wealth management firm has given me a bird’s eye view of what people are actually doing and thinking and saying in real life, as opposed to what they ought to be doing, thinking and saying according to the past. None of what I am seeing or hearing aligns at all with what most would have expected this far into a hiking cycle.

Outside of commercial real estate, the behavior of investors and consumers simply has not conformed to the expectations that would have been considered reasonable as recently as a few years ago.

I would point out that it’s not just the wealthiest who’ve benefited from the current situation.

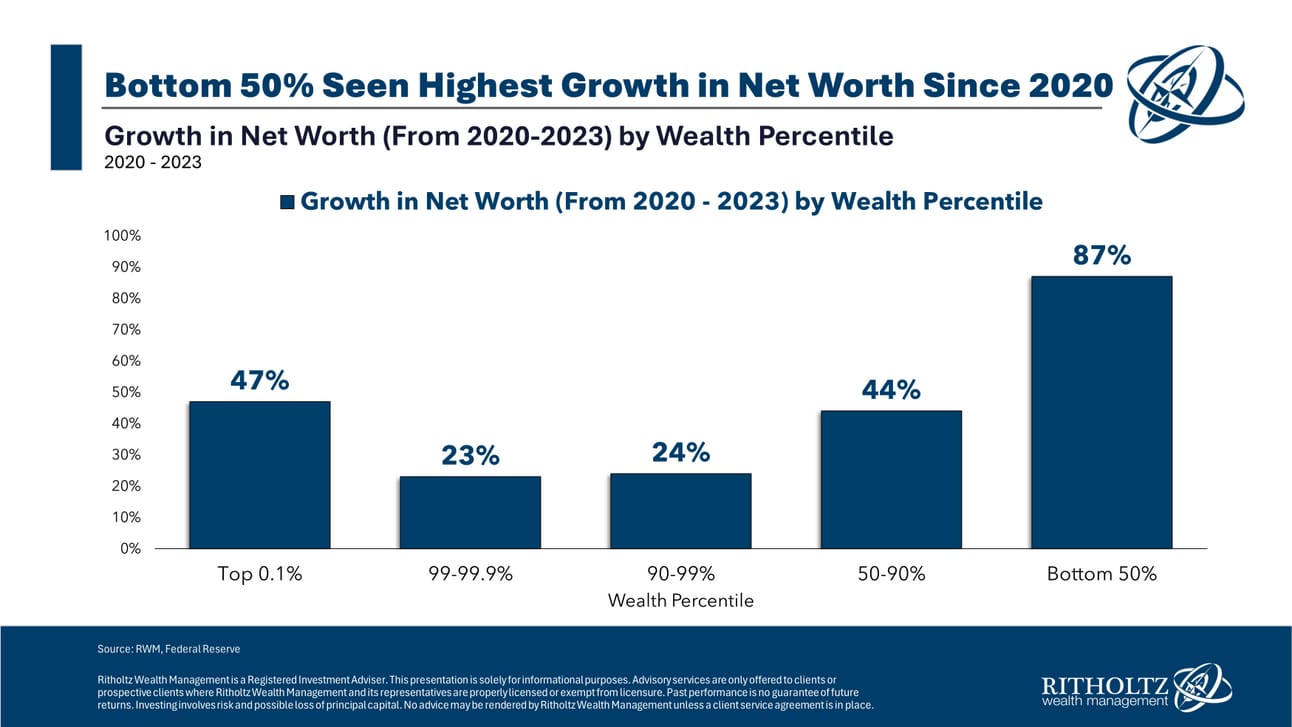

Ben Carlson’s post, “The Bottom 50%” makes it clear that net worths have been expanding for all cohorts…

Of course, the bottom 50% of households are seeing larger gains mostly due to the effect of it coming off a smaller base, but still.

Here’s the cash sitting in banks belonging to the bottom 50%:

That’s $280 billion, despite what you’ve heard about people “blowing through their pandemic cushion.” Now, of course, not all of this money is earning a high interest rate because the largest banks have gotten away with not passing it along. But a lot of it is earning higher rates. This is not to say that’s negating the poor sentiment around higher costs in the economy - Americans despise inflation, after all. But I would say that these higher rates on savings are offsetting the effect of high prices practically. Just enough to keep the expansion going. Even if they keep telling the surveyors that they are miserable.

I want to make it clear that what I’m describing here is simply an explanation for what has already transpired. I do not believe this is a permanent condition. As unexpected as the recent environment has been, we should not extrapolate these ideas further and fall into the trap of pondering the end of all economic cycles. The cycle will resume. The worm will turn. It’s only a matter of when, not if. But cycles can take a long time to play out. Especially when they’re being driven by unforeseen forces like this once-in-a-lifetime boom in investment income.

That’s all from me today. Until next time - Champagne Wishes and Caviar Dreams!