Why buy a single stock when you can own the entire sector?

Sector SPDR ETFs divide the S&P 500 into eleven sector index funds. Investors can now invest in just the slices of the S&P 500 they like best.

Learn more about Sector SPDR ETFs.

I don’t run a global macro hedge fund or time the markets with trades based on my gut instinct. It’s not part of our investing process as a firm and it’s not part of the way I personally conduct my own financial affairs. But I am also a sentient person with thoughts, feelings and biases and sometimes those attributes of my personhood add up to an opinion I feel like sharing. I write to find out what I think.

I give you this preamble so that you don’t come away from this post with the idea that I am telling you to do something with your own money (I am not) or that I have some sort of mystical ability to predict the future (I do not). What follows is an exercise in tying together some things I’ve learned in prior cycles with some observations I’m making based on reading news stories, listening to investors talk, watching market-related commentary on TV and the Internet and digesting research from all over the place.

And in tying together all this input, the output I come up with is I think the Nasdaq is topping out for the first quarter right now, potentially the first half and, of course, quite possibly for the year. I feel pretty good about it with the caveat that things could change and so too could my own mind. But this is where I’m at now.

If we see another 5% gain from here, I’m not wrong maybe just early. If there’s another 7 to 10% and we hold those gains through the summer, I am totally wrong. I’ll tell you so if and when the time comes.

It feels as though the tech / media / communications / discretionary sector rampage is flaming out. It doesn’t have to end with a bang, a whimper would do the trick.

This doesn’t mean I foresee a crash for tech. I own these stocks and will continue to. They’re up so much and have been up so much for so long that investors can easily withstand a correction or a period of poor performance that lasts throughout the year and still be very okay in the grand scheme of things. It’s unlikely to expect some sort of catastrophe given how much earnings growth has fueled the advance of these stocks. It’s not as though the rally has occurred at random or in some sort of vacuum. No, it’s not an index fund phenomenon. These businesses are flourishing.

Fundamentals Matter

Drew Dickson at Albert Bridge Capital took on the argument of whether or not there’s some sort of artificial (supernatural?) reason for the rise of the Mag 7 names. It turns out, earnings growth explains most of it.

Regarding Nvidia, he says “in the last five years, the stock is up about 1,700%. Guess what else is up about 1,700%? Nvidia’s earnings estimates.”

More:

How about Facebook, aka Meta, which goes through periods of hatred and love with equal vigor? Well, over the past seven years it has bounced around a lot but still has generated nearly 260% returns. And forward earnings projections? They’re up 280%.

We can stretch things further back, and look at Google over the past 14 years (earnings up 885%, stock up 980%); or Amazon during the same period (earnings up nearly 2,500%, stock up about 2,800%).

Or we can go waaay back and analyze Microsoft over the past 22 years. Forward earnings projections have increased from $0.93 in February of 2002 to $11.57 today. That’s nearly 1,150%. The stock is up just over 1,200%.

And finally, from one of my favorite former-CEOs Reed Hastings, we have good old Netflix. About 18 years ago, analysts were forecasting that Netflix would generate 11 cents of earnings in the coming 2006 year. Here in 2024, they are forecasting a whopping $17 of earnings in the coming year. That is a whopping EPS increase of 14,889%.

And how about the stock? We’ll it is up a whopping 14,882%.

Read the rest here:

So, okay. A big rally but a just one. But are people getting carried away? Has it gotten too easy, too obvious?

The QQQ ETF tracking the Nasdaq 100 stocks has just delivered a 21% average annual return over the last five years, and this is inclusive of a 32% crash for calendar year 2022. It’s up 18% annually for ten years and 20% over 15 years. It’s nothing short of miraculous - especially if you adjust for how pessimistic Wall Street professionals had been about investing during the outset of the post-Great Financial Crisis period. There’s no law stating that fifteen years is some sort of limit and on the sixteenth year we turn into a pumpkin. I just think it’s starting to shape up that way because of the recent acceleration in gains over the last three months.

Every $10,000 you invested in the QQQ in the early months of 2019 would today be worth $25,000. And since the start of the AI revolution about 14 months ago, the pace of these returns has gone from cool-blue flame to blistering white heat. That pace in stocks (and in life) rarely sustains.

I have some life and career experience with these things. No, it’s not a perfect parallel with 1999 but it’s also not a completely terrible parallel either. What’s missing is the IPO flood. Hasn’t happened yet, hung over as we all still are from ‘21. What’s not missing are the valuation leaps, the momentum, the excitement, the grand pronouncements, the feeling of being left behind, the innovation, the imagination, the storytelling - that’s all here, much of it with good reason. I’m not not excited myself.

So that’s the vibes. The vibes are immaculate. I almost feel like a dick for pressing publish on this. Lo siento.

And then there are the anecdotes. I won’t bother linking because I know you’ve read these stories too. There are always anecdotes that can make you think people are getting a little ahead of themselves, but these days the anecdotes are really piling up.

Nvidia became a $1 trillion dollar company and then became a $1.75 trillion dollar company a month later. And that’s before it even reports earnings for Q4 - it’s running into the number based on all the AI happy talk we’re hearing from its Magnificent 7 peers (according to reports, more than half of S&P 500 constituents are now excitedly chattering about AI in their earnings statements, from casual dining chains to auto parts retailers to oil companies to insurance companies). Every time a Fortune 500 CEO tells her shareholders she is excited about AI, Nvidia adds another $20 billion to its market cap.

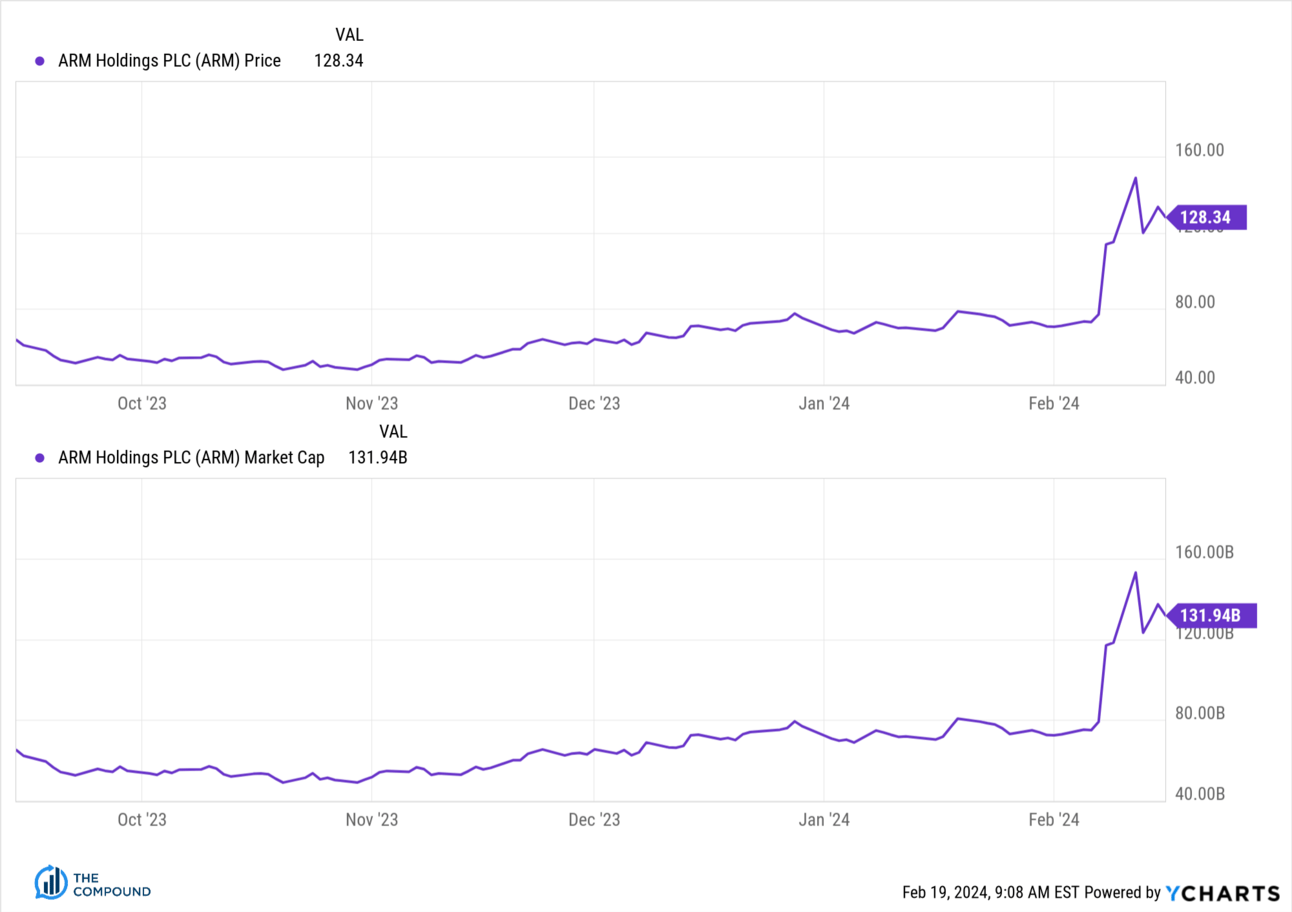

ARM Holdings, one of the largest semiconductor stocks in the world, saw its share price double in three trading sessions after reporting earnings. Yes, the company gave good guidance and is benefiting from AI-related demand. No, it’s not the second coming of Nvidia and has probably not seen a twofold improvement in its fundamental outlook. The stock market doesn’t give a shit. ARM got a double, just because. I mean, what if it doubles again and you don’t get in? Happened at AMD, after all. When people start thinking (and acting) this way, we’re closer to the end of something than the beginning. I show you the ARM share price and the market cap in dollars below to illustrate the magnitude of what we’re seeing now - yes, this is a $50 billion market cap grinding its way up to $80 billon over three months, and then $160 billion overnight:

That’s normal.

There’s more…

OpenAI’s Sam Altman openly musing about raising $7 trillion to build AI-enabled data centers. Then everyone scoffs at him so he does this, which is either serious or some sort of performance art.

Is he serious? If a Saudi prince called him and said “We’re interested…” maybe he is serious. If no one calls, it’s like “You guys, I was totally joking.”

The lines are so blurred, who can even tell anymore?

There’s also Elon Musk using the prospect of building AI projects away from Tesla as a means of compelling more voting power and money from the company’s shareholders.

And the Wall Street Journal’s tech reporters getting a lukewarm reaction from the corporate early adopters of its Copilot AI enabled software products - “It’s sort of okay!” seems to be the consensus if the tone of the article is to be trusted.

How about Sundar Pichai doing a 30 minute infomercial on CNBC for the rebrand of Bard into Gemini? This is for an audience of stock buyers, not necessarily customers or product users. When chief executives start turning their attention toward the perception of their products on Wall Street and not the actual use of them on Main Street, it’s usually not a great sign.

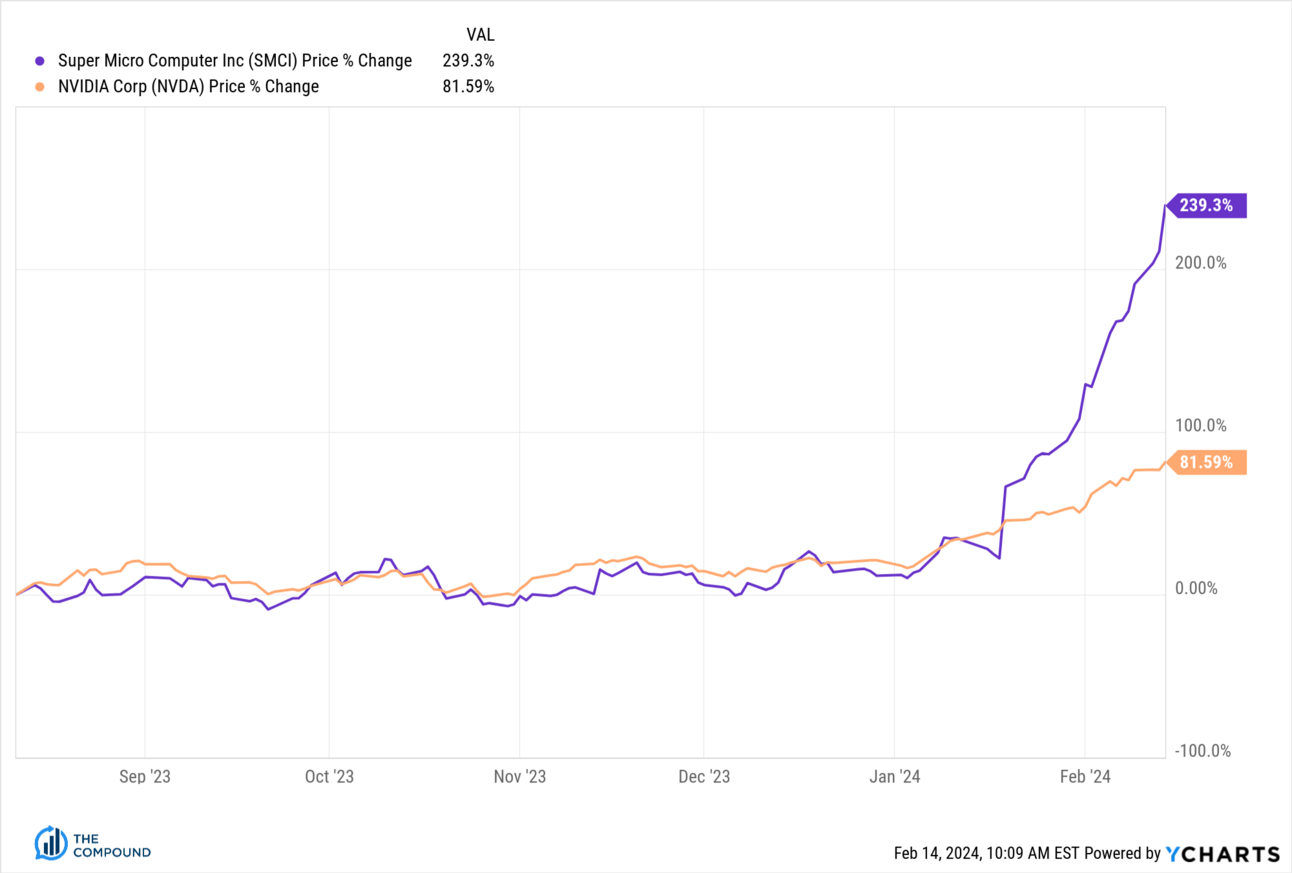

And then of course there’s Super Micro Computer (SMCI) - the poster child of this year’s tech-gasm. It’s an important company to the ecosystem as you cannot merely jam Nvidia GPUs into an old data center, clap your hands and shout “OKAY NOW DO AI!” This is one of the companies that will be very important to these build-outs all over the world and it’s got a rock-and-roll share price to match the story. Michael Santoli points out that it is now the reason, one some days, why the entire Russell 2000 is swinging higher or lower. It’s way outgrown its small cap brethren but Russell hasn’t recategorized the stock yet and moved it up. The last time we saw something like this was AMC and GameStop in 2021. Just saying.

Look at how pathetic SMCI’s rally made NVDA look…

…before a one-day 20% crash:

It’s like a hallucination of a daydream. Could it continue? Of course. Is it likely to? I don’t think so.

So what could go wrong?

What happens now? What could go wrong? Maybe a lot. Maybe nothing goes wrong but there’s no one left to want to buy. Maybe everyone has enough by now. That’s possible.

Or maybe something does go wrong. Maybe GPU demand (improbably) slows. A low probability bet but arguably a more out-of-consensus one with significantly larger implications than GPU demand ramping higher, is it not? If GPU demand picks up, well, everyone already believes it will and is betting that way. Don’t take my word for it, just look at the stocks!

The plural of anecdote isn’t “data.” I have data too. I don’t have time to write it all up. I have valuation. I have relative strength. I have oscillators. I can measure overbought conditions. I can measure sentiment. Trading activity. Volume. Big deal, none of that stuff has mattered the whole way up. But if you want to look, on any reasonable measure, these stocks should not be continuing at the pace they have been. For momentum traders, the more a stock goes up the better an idea it is to buy it. But those guys have sell rules. For everyone else, that’s not how it works. It just seems like it does. Of course you should buy (insert no-brainer winning stock) - it goes up every day! When too many learn the same game and it gets very easy to both play and teach to friends, the game breaks. Ask the Apes.

What now?

Put February 21st in your calendar. It’s Wednesday. Nvidia reports its earnings after the close that night. Last week the company became the third largest stock in the world, surpassing both Alphabet and Amazon. All three companies are designing chips for AI and cloud data centers and betting the ranch on AI, which is funny, but we’ll leave that aside. Suffice it to say, expectations are high for Nvidia. Of course they are. This company has just spent the last four quarters demolishing everyone’s expectations again and again.

I’ve owned the stock for the entirety of the last eight years so you’re not hearing this from the perspective of a bitter bear or an envious naysayer. You’re hearing it from a long-term investor: I think the biggest risk for the Nasdaq right now is a great report from NVDA that only results in a single-digit pop in the price. If that’s all we get, psychologically we’ll be in trouble. The air will come out of everything tech-related in response. In this particular moment, I believe the reaction to Nvidia’s quarter next week will tell us whether or not we’ve topped out for the time being. I think it’s more important than any inflation reading, economic data point or Fed speech.

I think it’s the whole ballgame for the most crowded trade on earth.

Saying the “B” word

Rich Bernstein thinks the similarities between 1999 and today are more important than the distinctions. He’s bullish on US stocks, just not these particular US stocks. His big idea is that AI is a distraction compared to the re-shoring, de-globalization story for the “S&P 493.” It’s not that he’s not excited about tech. It’s that there’s a lot more going on than large language models and GPUs and that the rewards might be greater for investors looking elsewhere. In early 2000, investing in anything that wasn’t the part of the Internet theme seemed absurd. Until it became a matter of portfolio and career survival just a few months later.

You can watch the whole conversation below and decide for yourself whether or not this time is different enough.

Thanks to the 40,000 people who have already watched this one - it’s really cool to see this much attention on a high-minded Investing discussion. We didn’t even have to get a tank to fire munitions at a Lamborghini.

OK, talk soon, happy Presidents’ Day - Josh