My Philosophy

This week the Dow Jones Industrial Average hit 40,000 for the first time ever.

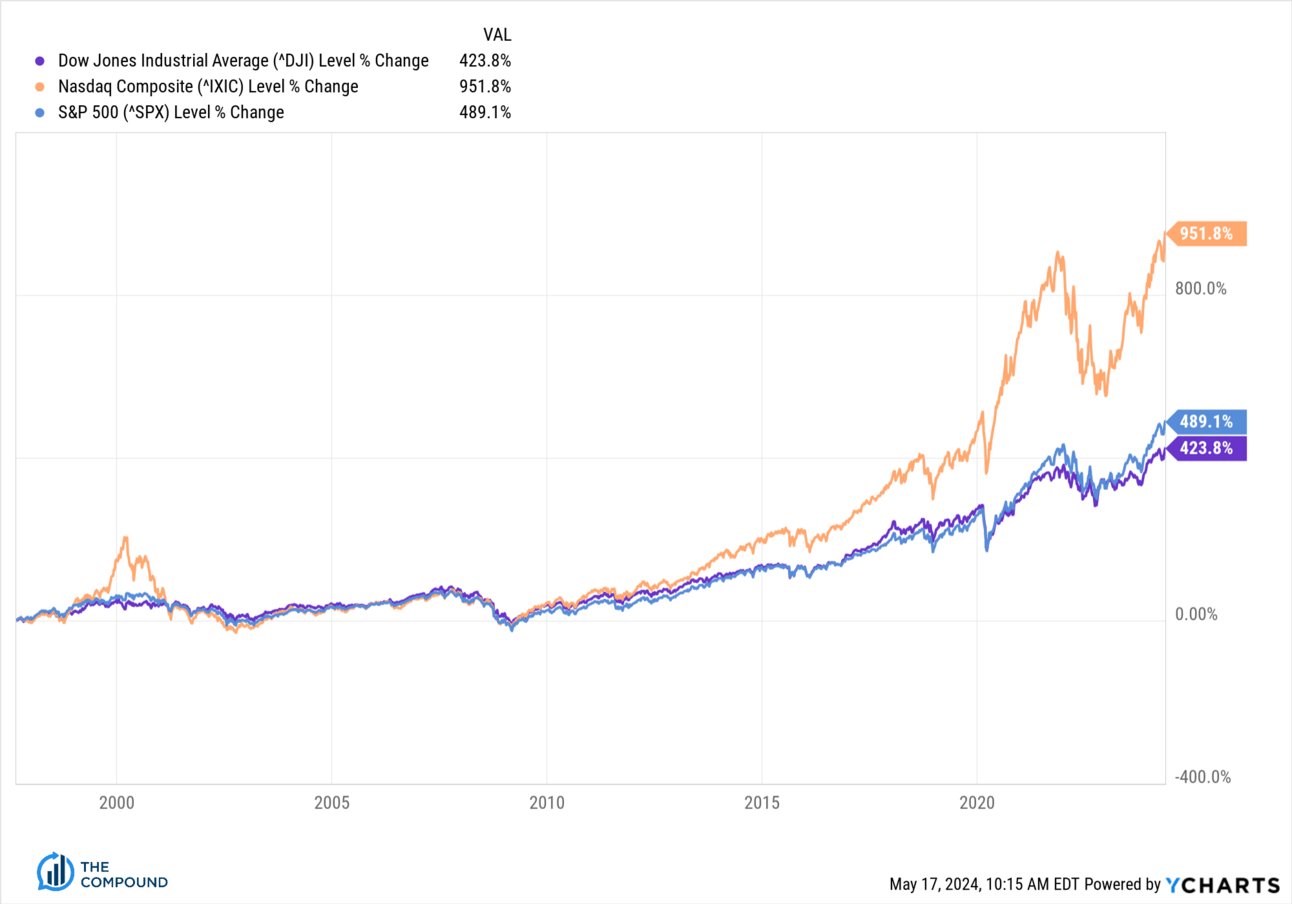

In the chart below, the index performance (not including dividends) since the day I first passed my Series 7 in the late summer of 1997:

In terms of returns, the Dow is up more than 400% - a fivefold increase in its price, again not including dividends, since the day I first got registered on Wall Street:

It’s worth mentioning that the S&P 500 index - again, price only and not including dividends, is actually up almost sixfold while the Nasdaq Composite has risen tenfold, a truly stratospheric return.

And during all this time, there have always been plenty of good reasons not to invest. There have been long stretches of time where it felt as if the risk outweighed the potential reward. There have been years during which investors witnessed their invested capital get cut in half. There have been moments of absolute terror, complete apathy, widespread despondency and emotional pain. Those moments were few and far between, but they occurred and we were forced to fight through them.

The less you paid attention, the easier it was to survive the worst of these moments. I was forced to pay maximum attention because, from the time I got licensed through today, I never went a single day without having a job and my job was always the stock market.

I’ve lived every rip and dip on those charts above. I was always here. I was always involved. Even on vacation. Even from hospital beds, hooked up to IVs with nasogastric tubes up my nose and down my throat while battling Crohn’s disease flare-ups. From then til now it’s been an unbroken chain of days and weeks, months and years, and I can honestly say I’ve been mentally and physically present for all of it, with real money and real responsibility on the line.

And I’m going to tell you something I hope you never forget - I will be here at 50,000 too. I will be here at 60,000, at 70,000, 80,000, 90,000 and 100,000 if God wills it.

I told you this four years ago at Dow 30,000, you can watch the video here:

I said it then and I am telling you again now.

My investment philosophy is the same as my business philosophy and it’s never changed:

Outlast the bastards.

That’s it. That simple. Can you do it?

The Optimist

Packy McCormack (Not Boring)

Packy McCormick of Not Boring is one of the most optimistic people I know. Even when there doesn’t seem to be anything particularly good happen. Especially then. He just radiates hope and conviction that the future will be better than the past. And he dives in to find the evidence as to why that should be true. It’s important to keep people around you who think this way, even if you don’t.

Michael and I have had Packy on the show a lot over the years. He is one of our favorite guests and we get to hear about all kinds of cool venture tech stuff when we talk to him.

This weekend’s The Compound and Friends features the return of Packy and a wide-ranging discussion about the state of VC investing, the latest developments in AI, lessons from the tech crash of 2022 and a whole lot more.

It’s up on all podcast platforms right now. Find it at the link below!

Ok that’s it from me today. I hope you have an awesome weekend. Talk soon! -JB