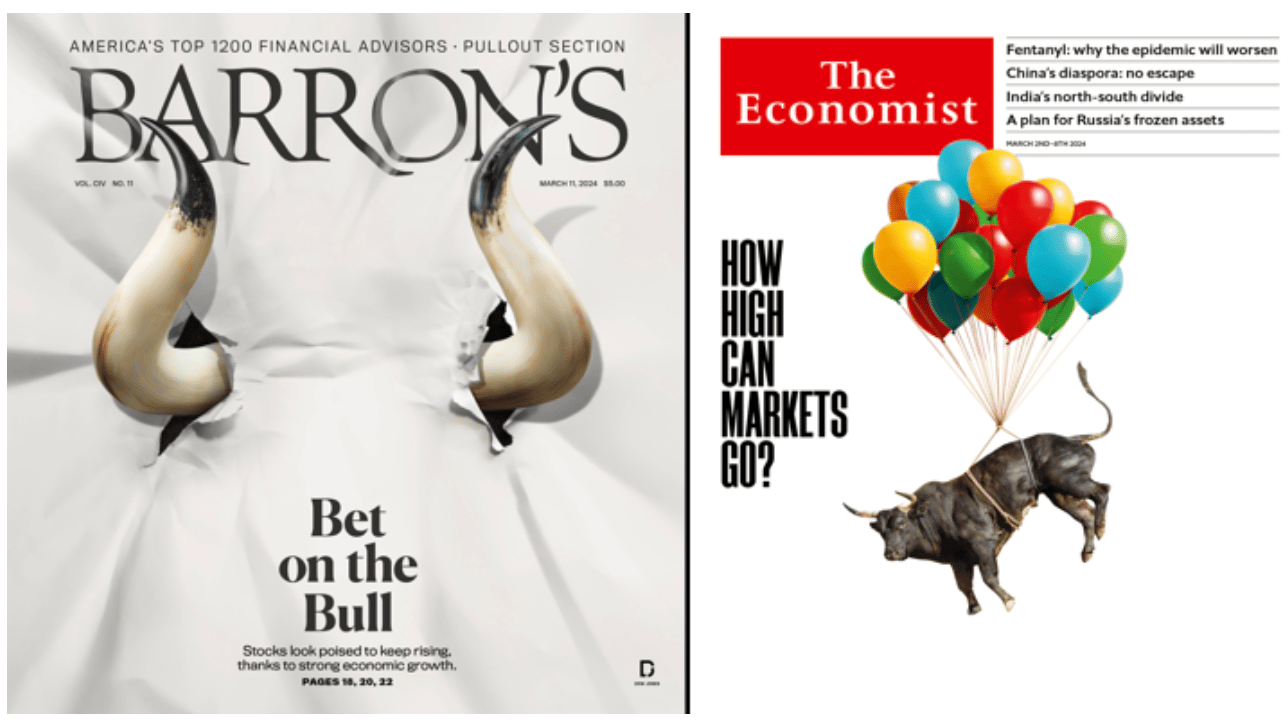

This week Michael and I were talking about the prevalence of bullish magazine covers lately. This was the one in particular that set off the latest round of kneejerk contrarian snark from the Zero AUM Club on social media

Jessica Menton at Bloomberg wrote it up:

This weekend’s Barron’s magazine cover saying “Bet on the Bull” was all over X, the social media platform formerly known as Twitter, as traders debated whether it was a sign of a top. Earlier this month, The Economist featured a bull on its cover, questioning “How high can markets go?”

What does this mean? Does the press talking up a bull market suggest the bull has gone too far — or that it’s just started running? The answer from experts: It’s complicated.

Thanks Jessica, I’ll take it from here. I see it as not very complicated at all. I will give you the five reasons why it’s actually pretty simple, you should pay no attention to this whatsoever. Commit as much of this to memory as you can. And then I give you permission to share this with the sardonic know-it-all in your life who delights in his own sardonic know-it-all remonstrations whenever he comes into contact with an optimist. Email it to him or print it out and ram it down his throat if you must.

Here we go…

Bull Markets Create Bulls

Of course people are bullish right now. It’s a bull market. What should they be doing, crying? We have clients who have started with us in just the last few years who already need to increase their future goals (or dial back on taking risk) because of the degree to which the stock market has outpaced the statistical models we use for return assumptions. You want these people to be pessimistic about the future? You want to see the tears roll down their cheeks and hear the lamentations of their women? It’s not going to happen. The best thing about this situation is that if you took the right amount of risk over the last ten years, you can now take much less risk and the money you put in cash will still be earning you something. It’s a win-win. Bull markets lead to bullish sentiment.

Hopefully you’ve been taking enough risk. If you have, you’ve been rewarded. If you’ve been listening to the people telling you not to, find some new influences in your life. You’re in the wrong algorithm.

Now imagine you’re sitting across from the person whose responsibility it is to help you plan and invest for retirement. Of all the aspects of the current investing landscape they might choose to focus on at the moment, the thing they want to talk about is a magazine cover. Seriously, they want to give you advice and formulate opinions based on what illustration some editor-in-chief ordered up for this week’s feature story. “Maybe we should trim our exposure here, did you see The Economist cover this week?”

You call yourself a professional, you son of a bitch?

Imagine that’s the person you’re taking advice from. I’ll pause to allow for the shudder currently running through your entire body…

Okay let’s continue.

Even Crashes Can Be Withstood

If you got off the horse during the 1982-2000 bull run (second greatest of all time) whenever somebody printed something enthusiastic about stocks in a magazine, you would have churned your own account to death a thousand times. It was a bull market with a handful of nasty bear surprises but, overall, most people were bullish throughout. There were tons of bullish magazine covers the whole way up. And life-changing returns over an eighteen year stretch. The worst moment of that nearly two-decade bull run occurred in October of 1987, coinciding with the release of Oliver Stone’s Wall Street film in theaters. Lots of people probably though that was the top. What if I told you the that the market’s recovery from the Crash of ‘87 was pretty much painless? What if I told you the S&P 500 actually finished POSITIVE for the year? Go look it up, it’s true.

This crash took place five years into that eighteen-year secular bull market, in part for technical reasons involving a popular product called “portfolio insurance” which was just a fancy way of saying hedging with options. People lost money. Firms were wiped out. For those taking the largest risks with the most leverage, the result was catastrophic. For most people it was a week’s worth of cocktail party chatter as the latest Def Leppard song played in the background. Probably Pour Some Sugar On Me. Although Aerosmith’s ‘Permanent Vacation’ album had recently come out in August so it might have been Angel or Dude or even Rag Doll. Guns n’ Roses’ ‘Appetite’ had come out a month before that so if it was, in fact, Sweet Child or Welcome to the Jungle playing, forgive me. I’m trying to paint a picture here.

So anyway, yes, there were fireworks. But no, there was no concomitant reaction in the real economy. We picked up the broken glass and the party continued. It was a record-scratch moment but not the end of the dancing. That’s why they call it the Crash of ‘87 and not the Bear Market of ‘87.

Which means you can have a magazine cover reflecting some bit of excessive excitement which may be dashed against the rocks by a garden variety correction or even a crash. And then the bull market could just as easily resume. After 1987, you had another twelve years to collect millions by simply sitting still.

False Alarms

For every time a hilarious-in-hindsight magazine cover has appeared before a crash, bear market or recession, there are a thousand times where a similar cover appears and no one gets humiliated by it immediately afterward.

Sometimes someone prints a bull on the cover and the market keeps going up. Sometimes someone puts a bear on the cover and stocks keep selling off for weeks or months after. It happens. A lot.

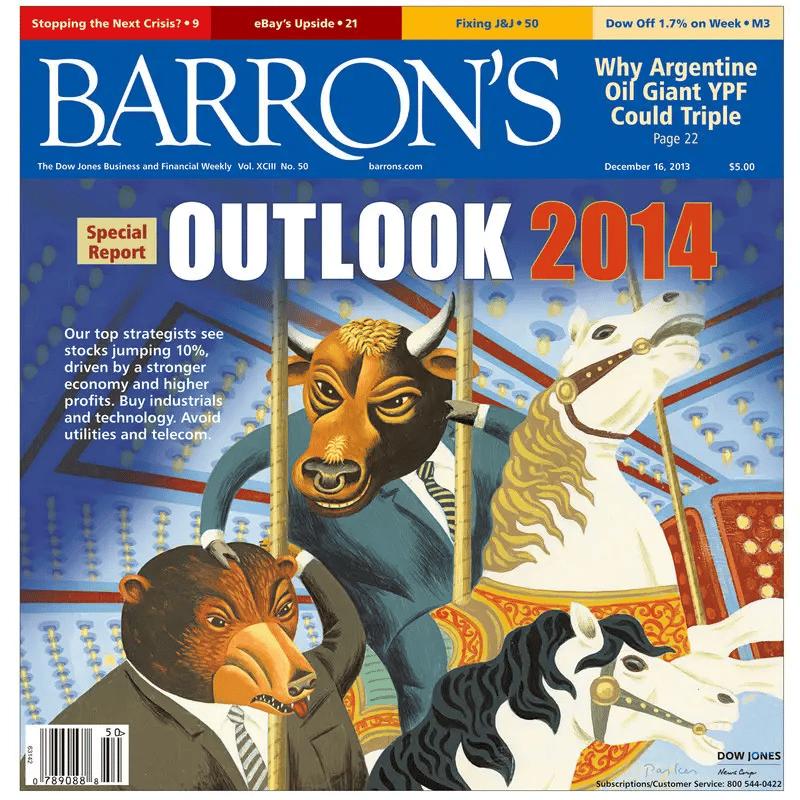

Consider the run of bull market covers in Barron’s coming in the aftermath of the Great Financial Crisis:

November 2010:

August 2011:

September 2012:

December 2013:

You bet your life there was snark all over Twitter and the blogs accompanying each and every one of these triumphantly bullish cover stories. TV segments were made. Newsletters were distributed. All the sad old macro men and incel daytraders were absolutely sure that these cover stories portended the end. Puts were bought. Investors were mocked. Posts were published. Tweets were retweeted. “Look how contrary and brilliant I am” they sneered.

And then something funny happened instead of the crash they’d been hoping for. Their backs were broken, their limbs trampled, their genitals torn off by one of the all-time great secular bull markets ever. This particular bull featured a shocking lack of volatility, the rise of the largest growth stock market caps of all time and a fifteen percent annualized return rivaling the gains from any other ten-year stretch in history. One for the record books. Trillions in wealth created.

Oops. Keep tweeting your Barron’s covers though. Hope it’s going well.

Why Are We Even Talking About Magazines?

My kids don’t know what a magazine is. If you want to reach them, you’ll need a beat by Mike Will Made It or Metro Boomin and you’d better have a dance routine that goes with it. Or they will take one nano-glance at your information and then swipe up and up and up until you’ve been scrolled into oblivion.

Free advice: Don’t get triggered by a form of media that literally no one consumes anymore. If a skateboarding bull falls in the forest and everyone is looking at their phones instead, does it make a sound? Does it make a difference?

It doesn’t. I’d be more worried about an investing trend on social media than I would the editor’s choice of cover illustration at Barron’s or The Economist. We had that in ‘21. Memes and trending topics are a better tell. I’ll be concerned when the rappers start looking for words that rhyme with Nvidia (Lydia? Namibia?).

So What?

Last one - the thing that sends us into a bear market is almost never too many bulls. Something else comes along to trigger it. The fact that there are too many bulls plays a factor in how fast and severe the correction is when it comes because extreme bullishness leads to concentrated bets and lots of margin buying and other behaviors inconcistent with proper risk management.

But if that’s not you, then who cares? If you’re keeping your expectations sober, sizing positions correctly, staying off the leverage drug and just generally behaving like a grown-up, so what if a bull market magazine cover causes (correlates with) a market top?

If this is the worst thing that ever happened to you, you’d be in better shape than 99% of the folks I talk to every day. I got people watching their husbands and wives deteriorate every day from Parkinson’s and dementia. I got people with teenage children undergoing treatment for blood cancers and bone marrow deficiencies and immune systems that attack their own bodies. I got people whose wives left them for the tennis pro and whose kids are now growing up out of their sight. I know laid-off people, chemo and radiation people, women burying their husbands and men saying prayers for their parents in hospice. And you want me to get worked up about a fucking cartoon bull in a boxing ring on the cover of a newspaper? Are you out of your fucking mind?

Go for a walk around town and ask the butcher, the baker and the candlestick maker which they’d rather contend with - their own problems or they can trade them away for a six month bear market. Tell me what you come back with. My god what are we even talking about here.

As my colleague Ben Carlson has demonstrated, even if you’re the world’s worst market timer and you ONLY allocate money to the market at historic tops, you still end up pretty okay so long as you don’t panic out at the bottom. Here’s the evidence:

The above literally represents a worst-case scenario. Most people, most of the time, do not take a huge lump sum and put it to work all at once right before a massive bear market. And even if they had, it’s not the end of the world as you can plainly see.

He did the first version of this table and commentary back in 2014 as a response to the hesitance among investors for whom the 2007 peak and crash were still front of mind. We’ve used this point to convince thousands of people - both clients and fans - over the years that they need to focus on something other than the specter of a generational top. We’ll keep doing this until. Until what, you might ask? Until forever. There’s no finish line. We’re never done. I tell my team that there are still millions of investors out there we need to rescue from the Money Slaughterhouse that exists all around us. If you see me next year or in ten years’ time, there’s a good chance that this is exactly what I’ll be working on. The future on my mind, crumpled up magazine covers under my foot.

You can watch Michael and I discuss magazine cover contrarians at the 55 minute mark (helpfully queued up for you) below:

Inflation in Plain English

This week we had Dan Greenhaus and Peter Boockvar on The Compound and Friends and it was one of the best episodes we’ve ever done.

Just look at the topic rundown below - we covered a ton of ground with two of the smartest people I know:

00:00 - Cold Open 18:41 - Intro 22:20 - Inflation in Plain English 30:33 - How is the consumer? 46:39 - The state of the market 51:58 - Comparisons to the '90s 01:08:06 - International Stocks 01:17:03 - Banning TikTok 01:24:16 - Where are the Tesla buyers? 01:27:36 - Favorites

You can watch it on YouTube here…

…or download the podcast to your favorite podcast app and listen while you something else.

Either way, you’re going to love hearing from Dan and Peter. We’ll do this again sometime soon, I promise.

Okay, that’s it from me - have the best weekend ever! Talk soon! - Josh