The New York Times sent reporter Talmon Joseph Smith out to the suburbs and exurbs of Pennsylvania to find out why people seemed to be happy with their own personal economic situation but unhappy with the economy as a whole. There are a lot of reasons. Today it would take $120 to equal the purchasing power of $100 in 2020, a twenty percent rise in the cost of living. Despite the fact that wage gains have occurred at the same time, in some cases eclipsing this twenty percent increase, people are still pissed off about it. They look at gas prices and they look at grocery prices once a week. They look at healthcare costs and rent once a month. They look at auto prices once a year, perhaps. Mortgage costs and rising home prices have made buying one’s first home seem an impossibility minus some help from the parents.

So they’re making more money and spending more money and traveling more and working plenty of hours. But the insecurities and bitterness of the post-pandemic period remain.

Most of the people Smith talked to don’t have six-figure securities portfolios. They’re middle class for the town that they live in but they’re not necessarily in the investor class. Some of them are on the road to get there.

The sooner they arrive and become part of the investor class, the more obviously their attitudes will change about the current environment.

As Professor Scott Galloway told us this week - and I’m paraphrasing - this is a country that is inhospitable to those who haven’t accumulated any wealth yet. We can debate whether that’s a good thing or a bad thing for America, we can debate the causes and whether or not this is intentional, we can debate the various solutions that have been proposed to make things more equitable (baby bonds or equity accounts for newborns might be a good start). We can argue until we’re blue in the face but one thing we can all agree upon is the necessity of ownership and equity for the advancement of our children. Families with wealth have a greater advantage than ever - an advantage that carries through from birth into elementary school and then secondary education. It feels as though the gap has never been wider and it also feels as though it’s been growing. Taking opportunities away from kids who have earned them is not a solution. Creating more opportunity is the American way, and that should be the focus.

People who are locked out of homeownership and working a job without corporate retirement plans are seeing the dream pull further away from their grasp - regardless of how hard they work. They’re just not in the game and it sucks.

The Investor Class

Investors, on the other hand, have nothing to complain about, regardless of a cost of living increase. Their net worths have lapped the inflation rate by three- or fourfold in recent years. If you hear the neighborhood multi-millionaire crying about his health care costs or his car insurance, you have my permission to laugh in his face.

The rate of wealth accumulation we’ve experienced in the post-pandemic period dwarfs the rate of cost increases we’ve had to endure concurrently. It’s not even close. The Dow Jones Industrial Average broke above 20,000 in 2017, a double from breaking above 10,000 for the first time in 1999 - that took a long time. The journey from 20,000 to 40,000 took no time at all.

If you’re in the investor class, you have my permission to stop crying. If you’re not, figure out how to make a change if you can - career, spending habits, educational attainment, something. It’s not going to be easy but I don’t see the pendulum swinging back the other way anytime soon.

Scott made his first appearance on The Compound this week to tell us about his new book, The Algebra of Wealth, available now everywhere. Scott explained that the book is not for people who are mired in credit card debt or in a difficult situation. It’s for the middle to upper class person who is doing well but wants to set their family up for lifelong prosperity and avoid the big mistakes. Scott has made many of those big mistakes on his way to great wealth and he humorously discusses them all for the world to see (and judge). It’s a courageous retelling of some of his not-so-greatest hits and a helpful guide for those who’d like to take a less dramatic path in their own lives.

You can watch our conversation with Scott below or check out the audio podcast episode of The Compound and Friends here.

Ladies and gentlemen, Mr. Art Hogan

We had an awesome discussion with my friend Art Hogan to end the week and the views are going nuts right now. Ben Carlson sat in too and the resulting conversation was dynamite - housing, oil prices, stocks, bonds, the Fed, asset allocation, digital assets, earnings - there’s nothing we didn’t cover this week.

Art is a fixture in the financial media and has been for thirty years, having made his first television appearance with Maria Bartiromo for CNBC in the early 1990’s.

Art has served as strategist, trader, board member and more for some of the most storied firms on Wall Street. He is a font of market wisdom and important context.

You’re going to love him in this format - no soundbites, no commercial breaks, just the man and his point of view…

Listen to Art Hogan instead, podcast version here.

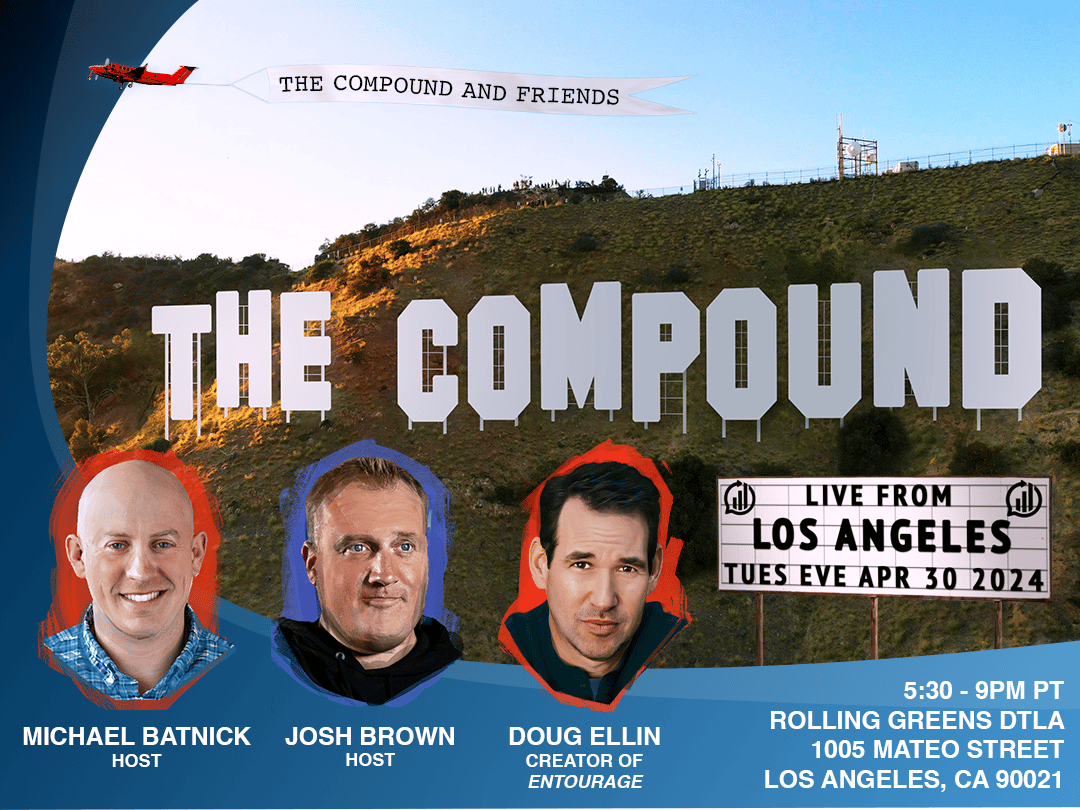

Doug Ellin

The other day we announced Matt Belloni of The Town as our first special guest for the live TCAF taping in Los Angeles. This week, we announced that Doug Ellin, creator of HBO’s ‘Entourage’, will be joining us on stage for a conversation about the creator economy, entrepreneurship and building a brand. Doug’s creation was one of the most beloved TV shows of the century so far, a cultural touchstone for an entire generation.

‘Entourage’ ran for eight full seasons on HBO, from 2004 to 2011, averaging between 2 and 3 million viewers per episode. The characters he created - from Vinny Chase and his brother Johnny Drama to Turtle, E and, of course, the estimable Ari Gold (played by Jeremy Piven) are still alive and well in the imagination of the show’s fans. Not a week goes by where someone I know doesn’t repeat a line from the show or cite one of its hilarious scenes.

Doug is working on some new stuff and I am so excited to bring you this interview on the podcast. If you’re in the LA area and you’d like to come to the event, tickets are available here:

Programming Note:

I don’t take a lot of vacations but this week I am officially away and on the beach. I’m going to the Caribbean and I’m not bringing my laptop. We’ll have an TCAF audio episode drop on Tuesday night as we usually do but this Friday the show is off.

Wishing you an awesome weekend, I’ll talk to you when I get back! - Josh