Differentiated Alternative Investments in Accessible Interval Fund Structures

CION is a leading provider of alternative investment products, offering institutional-quality strategies in interval fund structures and supporting advisors and investors with education and service to help build portfolios with potential to maximize risk-adjusted return.

Meltdown in the Gold and Silver Market

What a difference a week makes

How information spreads among traders in 2026: CNBC and Bloomberg are much less important as a transmission mechanism of stock or ETF ideas. They come in later and amplify what’s already happening. The new transmission mechanism occurs on message boards like Reddit, on social media (mostly Twitter) and on the trading apps themselves via “the community.” The apps are designed to increase engagement, keep traders checking in on their portfolios and, most importantly, doing transactions. That’s how they get paid. Nothing keeps traders active like showing them the gains and activity of other traders. So a theme like gold and silver becomes a giant meme once the trend becomes obvious to everyone via the speed of online chatter. The ETFs and associated equity plays bubble up to the surface and stay there, being shown to millions of eyeballs. Eyeballs that were staring at AI themed trades just a few months ago are now focused on miners, leveraged ETFs and all sorts of other precious metals stuff they’d never before beheld. Those eyeballs belong to people who don’t exactly know what it is they’re doing in the stock market in the first place. If you ask them why they’re trading, they’ll tell you “to make more money” and it’s not any more thought out than that.

Here’s my friend Todd Sohn’s chart (via Strategas) capturing the meme-ified madness in full swing from just a few days ago:

Imagine a million monkeys on typewriters attempting to produce Hamlet but substitute this futile pursuit of Shakespearean genius for an equally futile chase for Robinhood riches.

Of course, I am overgeneralizing because there plenty of experienced people who use these apps but, as a percentage of overall daily activity, they’re a rounding error. In the aggregate, it’s got all the sophistication of a shopping mall riot.

The masses are being herded like cattle into these trades via the same kind of algorithmic suggestion engine that’s made Billie Eilish and Sabrina Carpenter the stars of the Spotify era. Billie and Sabrina are amazing musicians and positively radiate star power and personality. They have a little something extra to them - Billie’s whisper / scream delivery and tomboy fashion, Sabrina’s sexually charged lyricism and an almost cartoonishly diminutive stature. This little something extra has captured people’s attention while catapulting their songs in the algorithms that determine what a hit is.

Once enough Spotify users agree that something is a hit, there’s a vortex effect that sucks in everyone until it’s just an understood thing that Billie and Sabrina are going to be everywhere each time they drop new music. This happened for Drake, turning him into one of the biggest artists of the Spotify era, a position he’s been holding for most of the last decade. These platforms are what made his career, to the point where when it appeared the algorithms had been deliberately turned against him in the summer of 2024, he took the record labels to court over it (and lost).

The popularity of these artists in the suggestion engines, like alchemy, is transformed into popularity in real life. I suppose it’s better than a radio DJ getting an envelope of cash to promote someone’s new single. I’m not complaining about how we create stars these days, I’m just pointing out that we’re creating popular trades the same way. People are having them served to them and opting in with buy orders, the same way they’re being suggested the new Olivia Rodrigo song once it’s been established that they also listen to Taylor Swift. “People who like to trade the 2x MSTR ETF also love SLV!”

What a debacle.

Too much leveraged retail money chasing the same “can’t lose” trade based on the recent returns and the story they’re telling each other about tariffs and Trump, geopolitics and societal collapse, on the message boards. You ask one of these people what they’re doing putting on leveraged silver trades after a quadruple in price and they look at you like you’re from Mars. They don’t say “I’m buying it because it’s going up” because that’s a statement so obvious it almost doesn’t need to be said. “Just look at it!” is what they’re screaming inside of their own heads. They’re talking about gold and silver around town and in the barber’s chair. “You should get in on this.”

And then, in one fell swoop, it’s all falls down.

My research team tells me we have daily trading data back to 1968 and this week featured the worst single day for silver prices ever.

Gold held up better, but still. For a risk-off trade, this was something else.

When the CME hiked its margins for gold and silver futures trading for the second time in a year, that was your signal that the authorities were seeing way more leverage and speculation in these contracts than they felt comfortable with.

From December 31st:

Gold and silver prices lost ground on Wednesday as investors booked profits after a historic annual rally and exchange operator CME Group hiked the margins on precious metal futures for the second time in the space of a week.

Spot gold prices dipped 0.1% to $4,339.89 per ounce at 8:50 a.m. ET, extending losses in the run-up to the new year. The yellow metal notched a one-week low in the previous session.

Spot silver prices, meanwhile, tumbled 5.6% to $72.15 per ounce, paring gains after climbing above $80 for the first time at the start of the week.

The moves come at the end of a blockbuster year for the precious metals.

Gold is up more than 64% year to date, on track for its best annual performance since 1979 and third straight positive year. The rally has been supported by a multitude of factors, including the impact of U.S. interest rate cuts, tariff tensions, and robust demand from exchange-traded funds and central banks.

Both gold and silver reacted to that bit of news by selling off for a few hours and then resuming their uptrends, trading signicantly higher throughout the month of January.

Until Friday.

Here’s GLD and SLV price along with drawdowns from all-time highs (in percentage terms)…

The scary thing is that both were so extended that, even with this massive one-day drop, they’re both still very much within statistical uptrends. I show you both versus their 50-day and 200-day moving averages - the rallies remain intact.

I wouldn’t touch this SLV blow-up here (leverage unwinds aren’t often a 24 hour kind of event) but gold looks buyable. Perhaps this was the refresh (and margin blow-out) that was needed to keep the bull market going longer.

If you’re long an asset, parabolic moves and meme-ification are not your friends.

I buy gold when it’s in a bull market. The last bull market ended badly (2011) and, someday, this one will too. I have no story about. No leverage. No theories. No mythology. No price targets. Maybe I’m just another monkey typing Shakespeare too, but in a downtrend I’m not reciting a thesis or praying for the selling to stop. I’m doing something else.

I like higher prices better than I like religion in a brokerage account.

The Greatest RIA Succession Story of All Time

Miss Nicole, Batnick, Chart Kid Matt, me and Kris in NYC this fall

You may have seen us in the news this week, especially if you work in the wealth business. That’s because we’ve just executed the best succession plan anyone has ever seen in the RIA world.

My partner Barry turned 64 this past fall and we began to talk about the long-term future of the firm we named for him when we founded it back in 2013. My partners Michael and Kris, along with many of our longest-tenured executives, are going to help me make a run for it. We think we have a good chance of becoming the largest, most successful truly independent advisory firm in America. Most of the other firms in existence that are our size or larger have already sold a stake in their companies to private equity funds if they haven’t sold outright to a PE buyer or a strategic acquirer. And that’s great for the founders who needed exit liquidity to fund a retirement or take their risk off the table.

But if that had happened to us, given our unlimited growth potential and explosive growth rate, that really would have been a shame. To see this firm turn into yet another merger morsel for the highest bidder would have been the letdown of my career.

Future Proof 2025, Huntington Beach with Kris, Michael, Ben, Dan L and our friend Stacie

Fortunately, Barry sees the same potential that all of our employee-shareholders see. And to facilitate our bright future as an independent firm, he’s done something truly heroic. By making his own shares available internally - at a lesser valuation than a PE firm would have purchased them at - he’s put his money where his mouth is. Almost no one else in his position has done this. It’s an extraordinary vote of confidence in the rest of us and a reaffirmation that there will never be a decision undertaken at this firm by anyone other than ourselves. Our clients can rest assured that we’re going to be here under existing management throughout their retirement. Our employees and advisors can go about their business without looking over their shoulders or wondering who the next owner is going to be and what they’re going to do to “drive synergies” or “introduce efficiencies.”

We talk to advisors around the country every day and many of them have relayed the disappointment that’s set in once the founder hands his or her ownership off to someone from the outside who isn’t emotionally or spiritually attached to the business. It starts with small changes and leads to bigger ones - even potential conflicts of interest with the clients depending on the situation. There’s a lot of disillusionment out there, especially among advisors who’ve jumped to one of these firms expecting independence. Finding themselves back in a neo-wirehouse situation with financial or contractual handcuffs attached is pretty depressing. Now, granted, we don’t hear from people who are happy, and there’s probably plenty of that too - we only hear about the shitshows.

lobster roll-loading before the Peter Lynch podcast recording in Boston

The thing is, there are a lot of shitshows these days. Some of the largest aggregators or roll-up RIAs in America are now owned by Middle Eastern sovereign wealth funds, Canadian pension funds or professional bean counters from Boston. Predictably, the vibes are now pitch black. There are lots of quiet implosions occurring as charismatic founders depart (or get pushed out) and the fleece vests move in. I know of one mega RIA that hasn’t had a CEO since the fall and spends as much time suing its departing advisors as they do actually giving advice to clients. They’re like a law firm with a financial planning business on the side. Imagine working there.

The execution of our internal succession plan necessitated an early update of our annual Form ADV filing, which also revealed that we’ve grown from $5.6 billion to $7.6 billion over the last 12 months through 12/31/2025. I don’t know how many firms of our size are organically adding assets at a rate of $2 billion in a year but I would bet there just aren’t any. You have to get the magnitude of what we’re doing to understand why I’m so zealous about maintaining what’s special about this place and these people. Barry’s decision allows us to do exactly that - maintain the magic that is Ritholtz. We now have 29 shareholders among our 86 employees and more will be added as time goes on. Most importantly, no one else outside the firm has any say in how we operate whatsoever. And, god help me, I will keep it that way for as long as I can.

the night we took over Chicago last summer

As the CEO and largest shareholder, the responsibility I now feel is monumental. I’m going to do my best. I told my partners and staff that I will not let them down. And if you’re a client of the firm, that means you. I got you.

And if you’re a financial advisor who is reading this and saying “Hey! That’s what I’m looking for!” No problem, shoot us a note. I can’t guarantee an immediate response but we would absolutely love to hear your story.

Thanks to all the reporters who covered our transaction this week.

Here’s Barron’s:

And here’s wealthmanagement.com:

I couldn’t respond to every single well-wisher and commenter who offered their words of encouragement and support this week so consider this my heartfelt thank you. On behalf of all of us here at Ritholtz, we love you back.

Tom Lee Returns on The Compound and Friends

My friend Tom Lee has been persistently bullish on the US stock market for as long as I’ve known him and, despite environments like 2011, 2018 and 2022, it’s paid to listen to him. His optimism and “yes, but what can go right?” mentality have helped millions of ordinary people (and institutional investors) reap the gains of the current secular bull market despite the legions of naysayers and moments of uncertainty. Tom’s research emphasizes demographics, credit availability, earnings growth and innovation to make these calls. It’s been the right set of variable to focus on and probably will be for the foreseeable future.

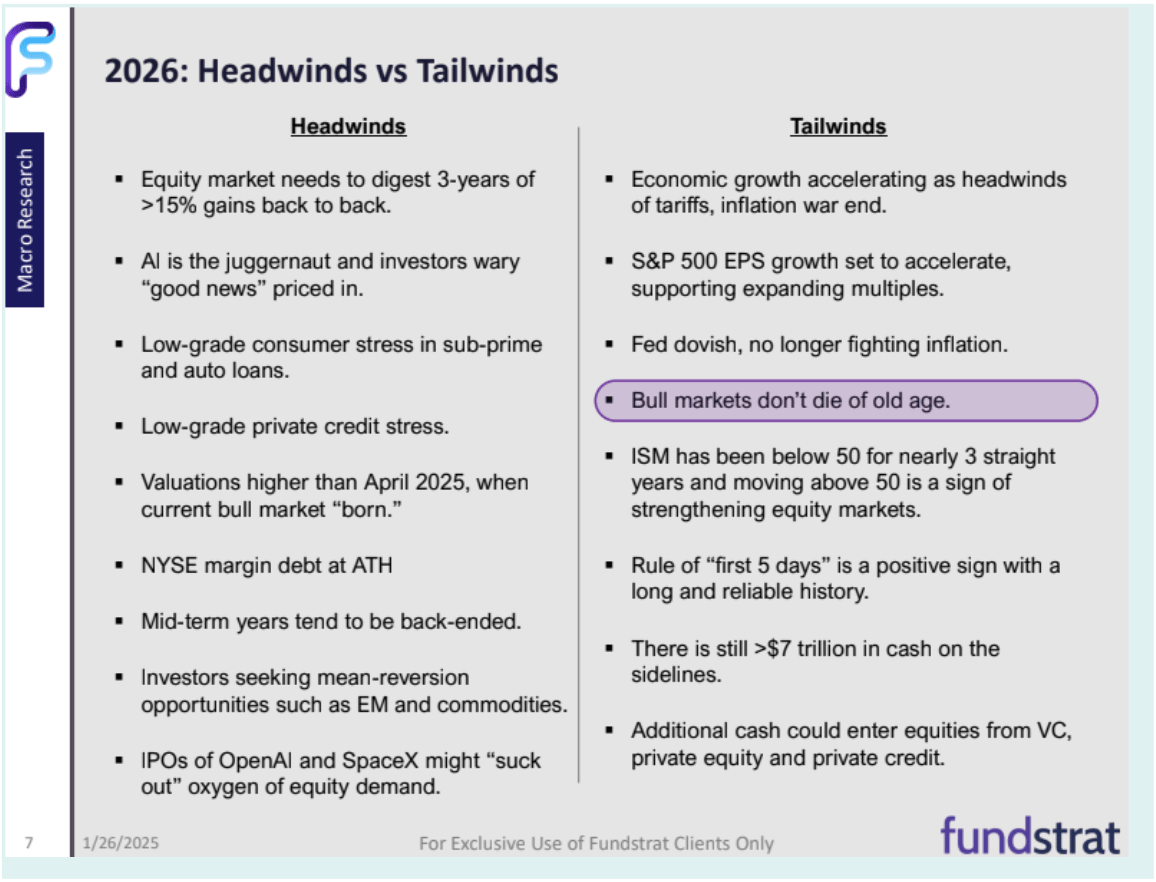

Tom is upbeat about 2026, a year he thinks will look a lot like 2025. But there are some headwinds he’s worried about, which we got into on the pod this weekend.

You can see these cataloged below, along with the (hopefully) offsetting tailwinds he believes will win out as the year goes on.

You can listen to the whole conversation at the links below on either Apple, Spotify or watch it on YouTube. Subscribing to the shows on the service of your choice means never missing an episode, delivered directly to your feed.

Want to go deeper? The Compound and Friends has an email newsletter in which we reveal the next guest on the show and share lots of other behind the scenes stuff. You can subscribe here:

The Compound Insider

What Tom Lee’s Worried About in 2026

THE COMPOUND & FRIENDS

What Tom Lee’s Worried About in 2026

Michael Batnick and Downtown Josh Brown are joined by Fundstrat's Tom Lee to discuss: market headwinds in 2026, why Tom is still bullish, the precious metals rally, the crypto bear market, Tesla's big bet on robots, and much more!