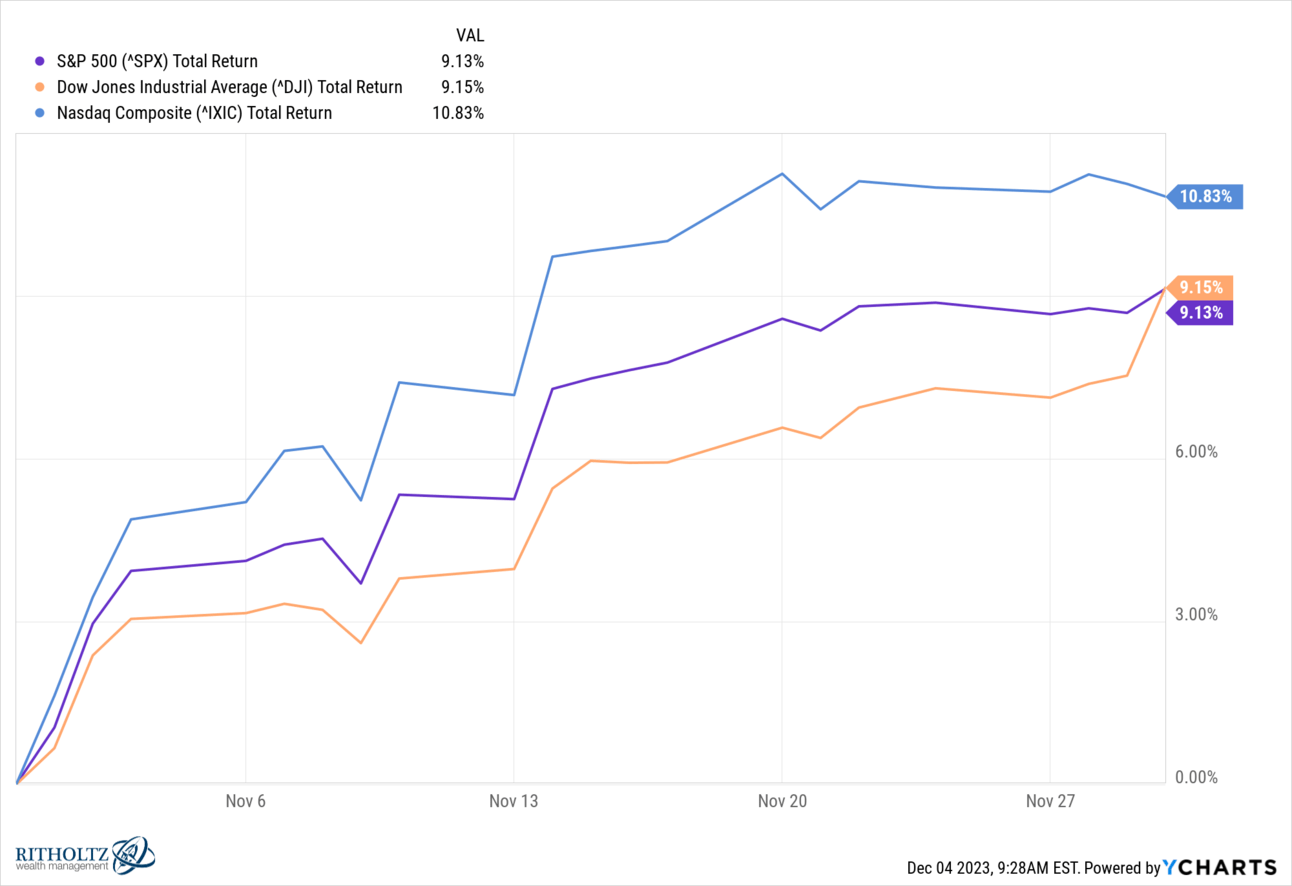

November 2023 will go down in history as having been one of the best stock market months ever. The Dow Jones and S&P 500 did 9% and the Nasdaq did 11%.

Why did that happen and can the rally continue?

As with most things market-related, there is not a single answer I could give you that would explain last month’s rampage, but there’s one factor I could point out that I think explains a lot of it.

The October Non-Farm Payrolls report came out on Friday November 3rd and surprised The Street with its moderation. New jobs added surprised to the downside. The headline unemployment rate also ticked up (now at 3.9%). Stocks staged a massive rally on that news and then never stopped going up.

It wasn’t just the report itself, though. The context in which this happened is really important.

It should be noted that during the third quarter the Dow Jones, S&P 500 and Nasdaq were all negative. Stocks peaked at the end of July and spent the next 90 days in turmoil. This sell-off was accompanied by persistently lingering inflation worries and the higher Treasury bond yields that result from these concerns. Economists agreed that the source of these inflation issues was the continuously surprising strength of the labor situation, with supply chain pressures having already faded away.

So getting this confirmation of labor market moderation on November 3rd was the spark. Bond yields fell, removing some competition for stocks from cash and money market funds. In the meanwhile, corporate profits had held up with Q3 now looking like the end of the earnings recession that had begun in Q4 of 2022. S&P 500 earnings grew year over year this reporting season, after having contracted during the prior three quarters. Was that the turn?

Lastly, with job openings still plentiful and a consumer still spending at a positive rate despite higher borrowing costs, the Goldilocks scenario became consensus. By which I mean, it became non-embarrassing for economists and stock market watchers to posit that perhaps this time, we’ll have a inflation normalize without a recession. Ed Yardeni calls this idea the “Immaculate Disinflation.” Heaven without Hell. Price pressures subside without millions of layoffs being necessary.

This is what has actually taken place thus far. It’s the biggest story of 2023.

I reference this November 3rd release of October unemployment because we’re getting the November report this Friday at 8:30am Eastern. It’s the last Non-Farm Payroll report of the year. It precedes the final CPI inflation reading (December 12th) and the last FOMC interest rate decision (December 13th) by just a few days and it’s probably going to seal the deal.

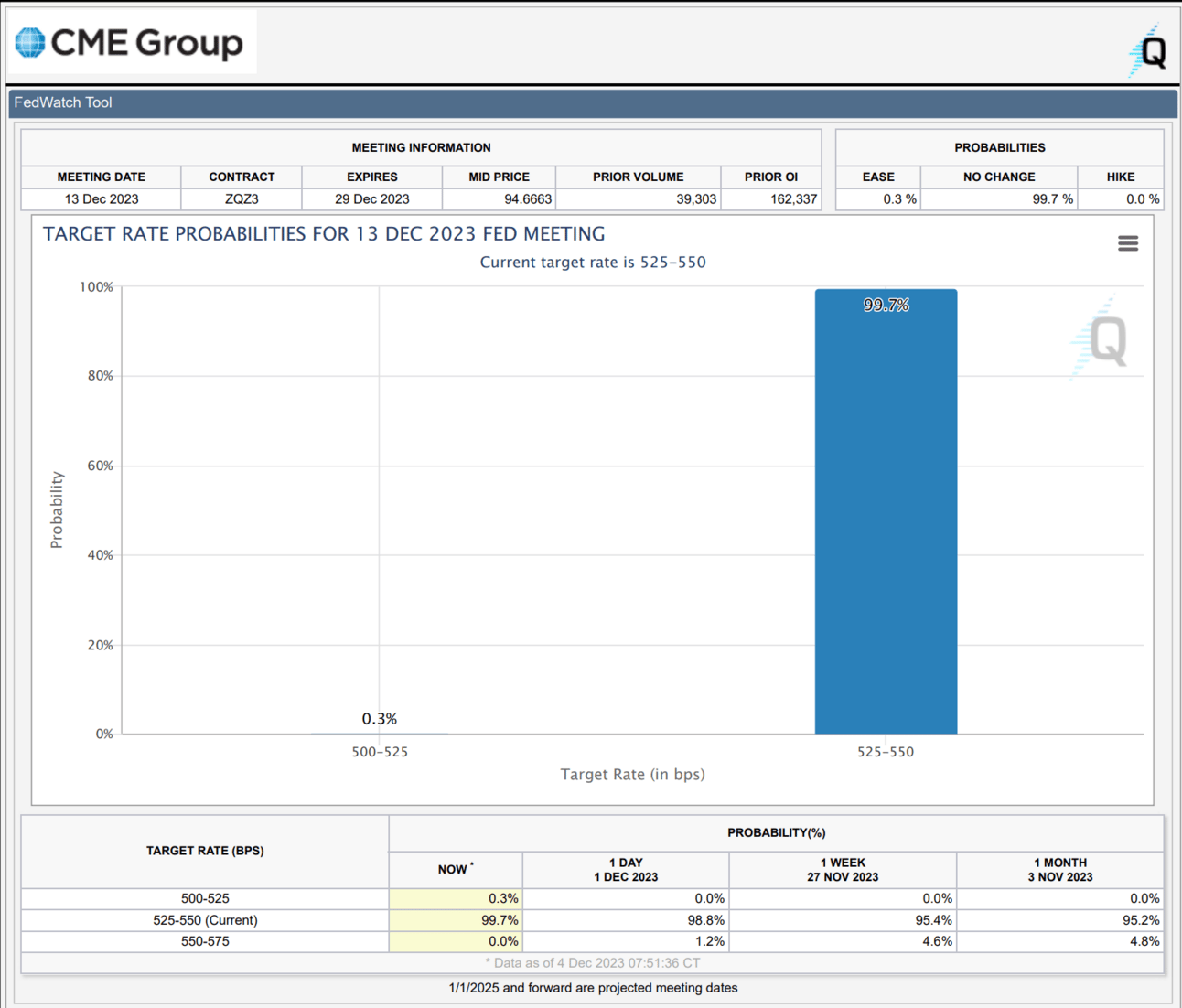

Here’s the CME’s FedWatch tool, which calculates the odds of a hike or a cut based on the bets traders are making:

That’s a 99.7% probability of no hike. About as high-conviction as you can get.

If the Federal Reserve does not move this month, it will be the third month in a row they stand pat.

If anything were to change their minds between now and the December 13th meeting, it’s this payrolls report. The Street is expecting 200,000 jobs added in November, which would be a gain from the last month but would also have a lot of seasonal elements mixed in because of holiday-related hiring. Let’s assume we come close, above or below…who’s selling stocks on that news?

So, in my opinion, the only known unknown standing between us and a nice finish for stocks into year-end is a large upside hiring surprise in the November NFP which we will have in our hands Friday morning. Absent that, I would guess that we’re good til the New Year.

As my pal Brian Belski likes to remind me, we deserve it. We’ve been through a lot. We shouldn’t be so hard on ourselves and constantly expecting negative outcomes. This December, I’m going to heed his advice.

This Week on The Compound

Join us for a new What Are Your Thoughts tomorrow night at 5pm EST on YouTube. You can be part of the chat and weigh in on the topics of the week. Michael Batnick and I always get a kick out of your comments.

If you’re subscribed to the channel, you’ll get the alert.

We’ll be back tomorrow night and at the end of the week with brand new podcast episodes of The Compound and Friends. All the links you need to hear that show on either Spotify, Apple or elsewhere can be found here, plus a signup to join as a Compound Insider: