Prices vs Narratives

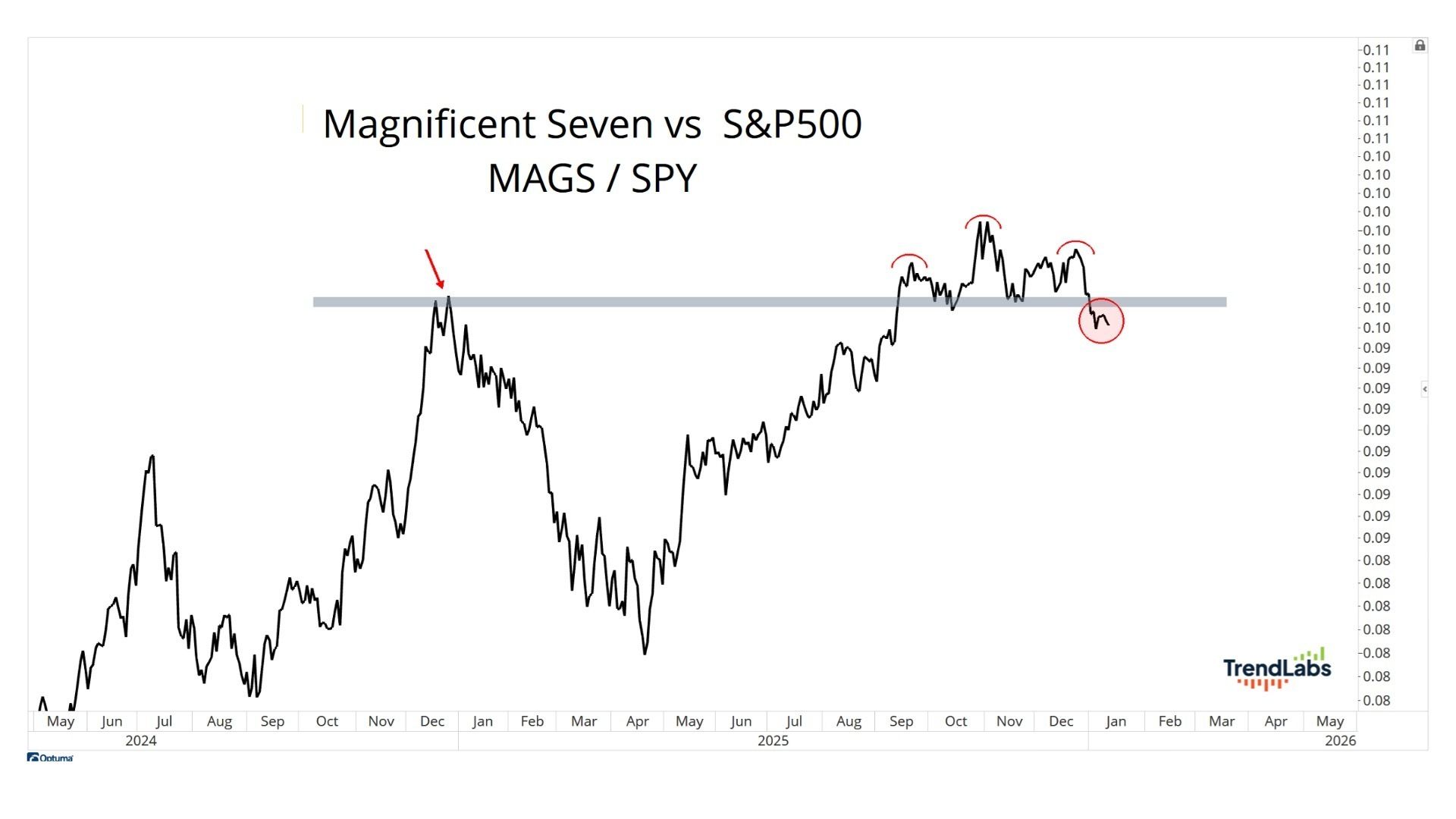

What you’re looking at above is a great example of a phenomenon I want to teach you about today. It’s a chart from my friend JC Parets at TrendLabs who points out that, contra to all the bubble talk in the stock market surrounding AI capex, the companies building the data centers actually saw their share prices peak relative to the rest of the stock market way back in October. They stopped going up a long time ago, with the exception of Alphabet (GOOGL). This is a ratio chart of Magnificent 7 stocks (colloquially, “the AI Trade”) versus the SPY ETF. Could be noise and a false breakdown - or the start of a larger roll-over. We’re watching it.

But the prediction people can make from this is not the point. Rather, the fact that the price action has changed while the old narrative about a bubble persists is what’s interesting here.

Year-to-date (through midday Friday) this is how the field looked:

GOOG +6%

AMZN +3%

NVDA +1%

TSLA -2%

MSFT -5%

META -5%

AAPL -6%

Not that we’re terribly concerned with stock prices in a two week window, I’m just illustrating the point that it’s hard to have a bubble in AI data centers if the AI data centers’ owners and largest customers aren’t playing along. I think this is perfectly healthy. I don’t think we should be rooting for $3 and $4 trillion market caps to be exploding to $5 and $6 trillion. Gains in moderation, given what’s gone on over the last three years, are better than a parabolic, blow-off top. I love the tape these days. Most investors should. All sorts of reasonable, rational games are working here.

Rocket from the Crypt

I’ll show you one we haven’t talked about in awhile. I don’t know if you remember a few months back I had the CEO of Rocket Companies, Varun Krishna, on Live from The Compound. He was great. Rocket has built America’s killer refi machine. Varun called it an engine. Rocket has ten percent market share in refi, nationwide. And while mortgage rates sucked this past year, he made two critical acquisitions to prepare for the turn - first, he bought Redfin, a leading real estate portal on the internet for both house-hunters and the brokers in search of them. Then they closed their acquisition of Mr. Cooper, the largest standalone mortgage servicing platform in the country. These deals gave Rocket an end-to-end answer for consumers, from finding the house to applying for a loan to closing on the property to making mortgage payments. They are now dominating the mortgage business and the mortgage business is coming back to life.

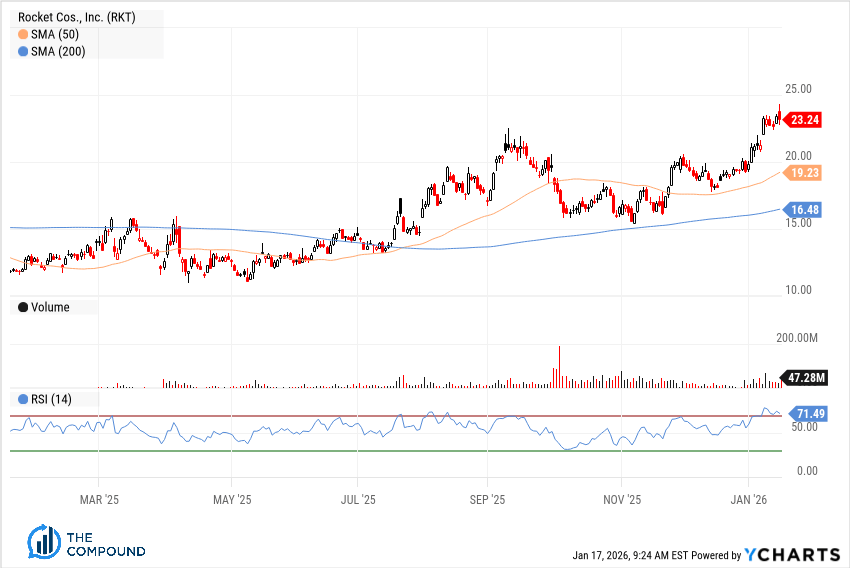

As I explained in the video, I am a shareholder in RKT so I am, of course talking my book (who the hell’s book am I supposed to be talking?). The stock is up over 100% over the last 12 months and I don’t think it’s done going up. I used the Liberation Day sell-off in April to lower my average cost (the stock sold down to $11, inexplicably) as I explained on CNBC that afternoon (watch the clip here).

A simple question

I asked a very simple question, rhetorically - the question I asked myself as I pressed the buy button near 52-week lows for the stock:

“Who benefits the most if we were to see five Fed rate cuts or even directionally if we got three or four? And the answer is obvious, you’re going to get a refi boom. You’re going to get action in the existing home sales market, and you’re going to see people take advantage of that, especially if they’re struggling in the economy. That’s exactly when you would get a refi. Boom happens every time. So Rocket is uniquely positioned. And they’re very—they’re very aggressive repositioning themselves for what could be. They’ve announced two acquisitions in the last month. One of them the other day is Mr. Cooper, which is the largest mortgage servicing companies in the country. And the other is Redfin, which gets 5.5 million unique users on the website. It’s a business of selling leads to realtors, but also that’s a huge funnel for Rocket to sell mortgages to the consumer through. So this is the type of company that benefits if mortgage rates come down meaningfully and we get a refi boom and we break that logjam of all of these homes not on the market that need to be. So that seemed really obvious to me.”

My thought process was that, as bad as the current narrative was for the mortgage business, prices would change faster than people would be able to process the changing of the story.

Well, the refi boom is coming. It took awhile but last week the rate of a 30-year mortgage finally dipped below 6%. In the 5’s, you’re going to see some action.

Don’t listen to my opinion on the subject. Listen to what buyers and sellers of the stock are telling you:

If you missed it, there will be down-days and dips. The company is in the early innings of a turnaround just at the moment its whole industry is seeing a turn for the better. I love situations like these. The refis are just the start of what should be a generally better housing market with more turnover and increased buyer confidence so long as the labor market holds up.

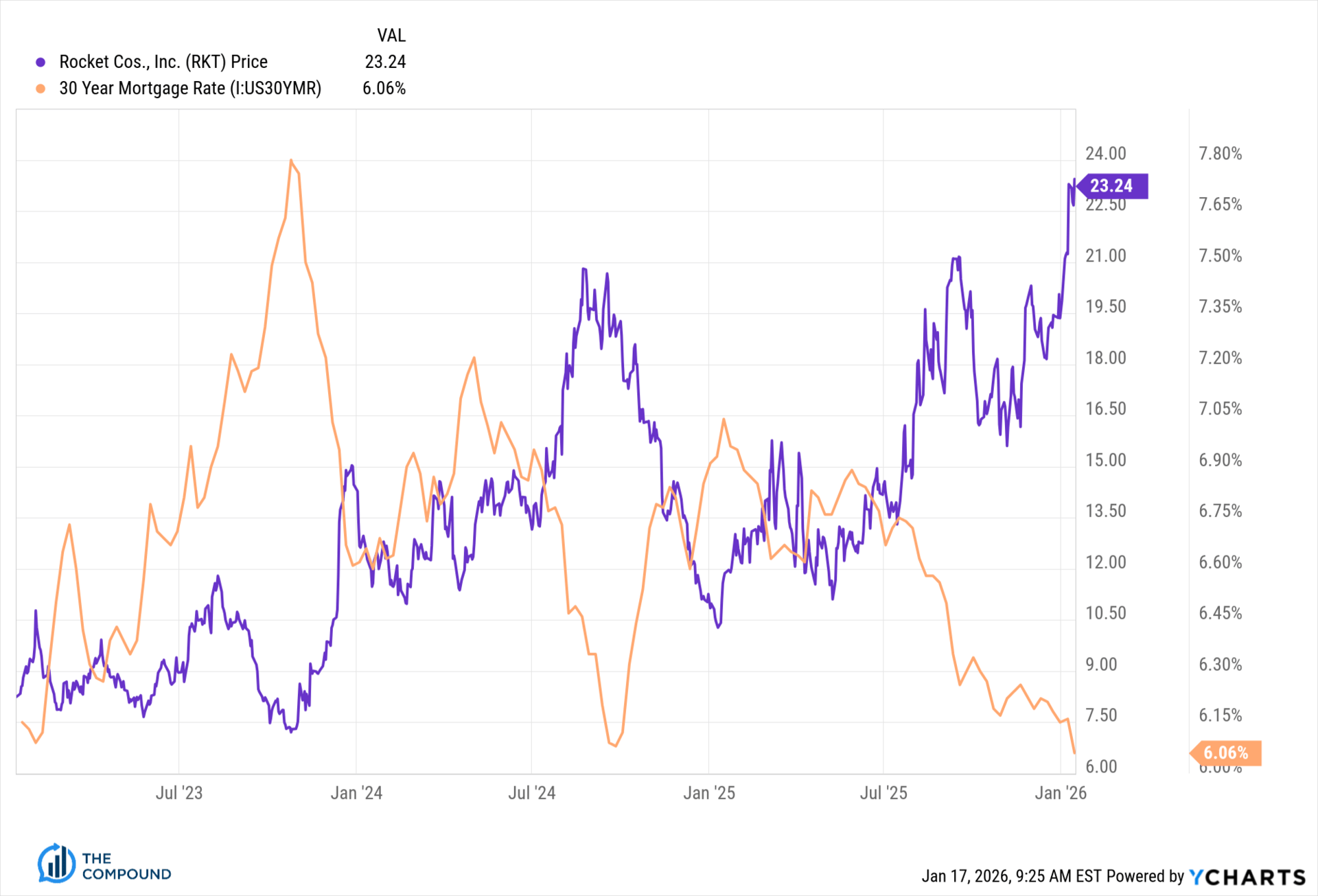

And, just for fun, we shared this chart a while back on What Are Your Thoughts, it shows the sensitivity of Rocket’s price relative to prevailing 30-year mortgage rates:

You would think this would have been obvious to investors last year but, alas, they were still hearing the old story.

This past week things began to change. Now it’s not just the Federal Reserve cutting interest rates. Trump is directing the Federally-controlled housing agencies Fannie and Freddie to utilize a combined $200 billion of their capital to purchase mortgage bonds in the marketplace, thus pushing down borrowing rates across the system. It’s not “Quantitative Easing” insofar as the money to do this is already sitting on the balance sheets of the two GSE’s, as opposed to being printed out of thin air as it was for previous QE programs. I think of it as mobilizing assets that are otherwise not contributing to a solution to the affordability “crisis.” Of course, the counter-argument to doing this is that it’s just going to push up the prices of homes, and maybe that’s what happens, but price appreciation won’t be equally felt by everyone, everywhere, so the bias toward action is probably a net win for the market. We need to create turnover and break the ice.

Not that a 5% and change mortgage is terribly attractive in absolute terms, but it finally might be in relative terms. Remember - the narrative was that the housing market is dead and homeowners are locked up because high rates make it undesirable to move or refinance. That’s an old story. The price of Rocket has already doubled and people still haven’t stopped telling the old story. Once people learn a story, they get good at telling it - to themselves and others - so they just keep telling it. By following price, you can see reality changing (or perceptions changing) before the new story becomes widely told.

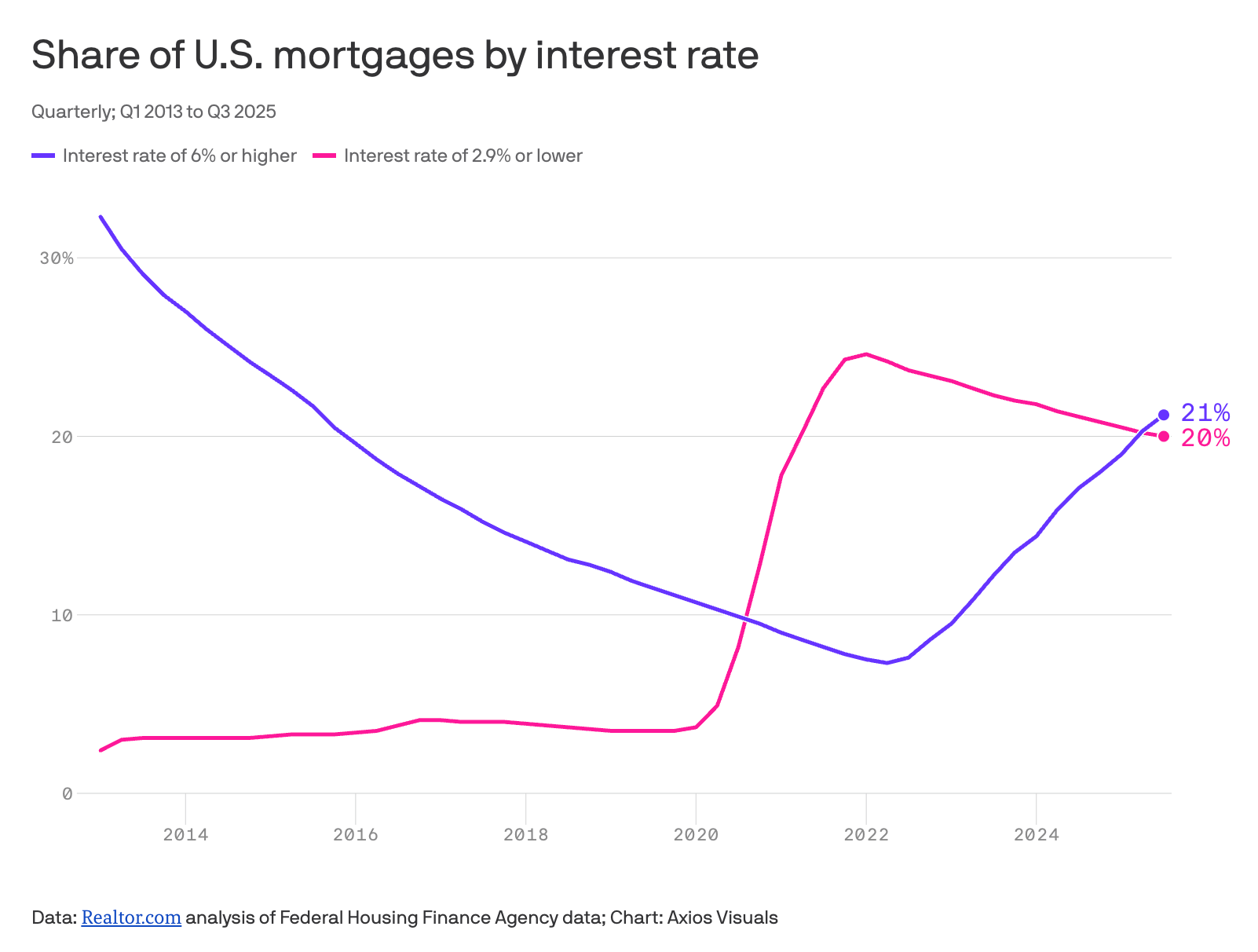

Here’s the new story - “The golden handcuffs are slipping: For the first time since 2020, the share of U.S. homeowners with mortgages set at 6% and higher, exceeds those with mortgages below 3%.”

It’s a start.

Chart via Axios:

Tell me, is anyone telling this story yet? Nope. They’re still talking about frozen sellers and locked out buyers.

I remain long RKT and short storytelling.

The stocks to buy in 2026

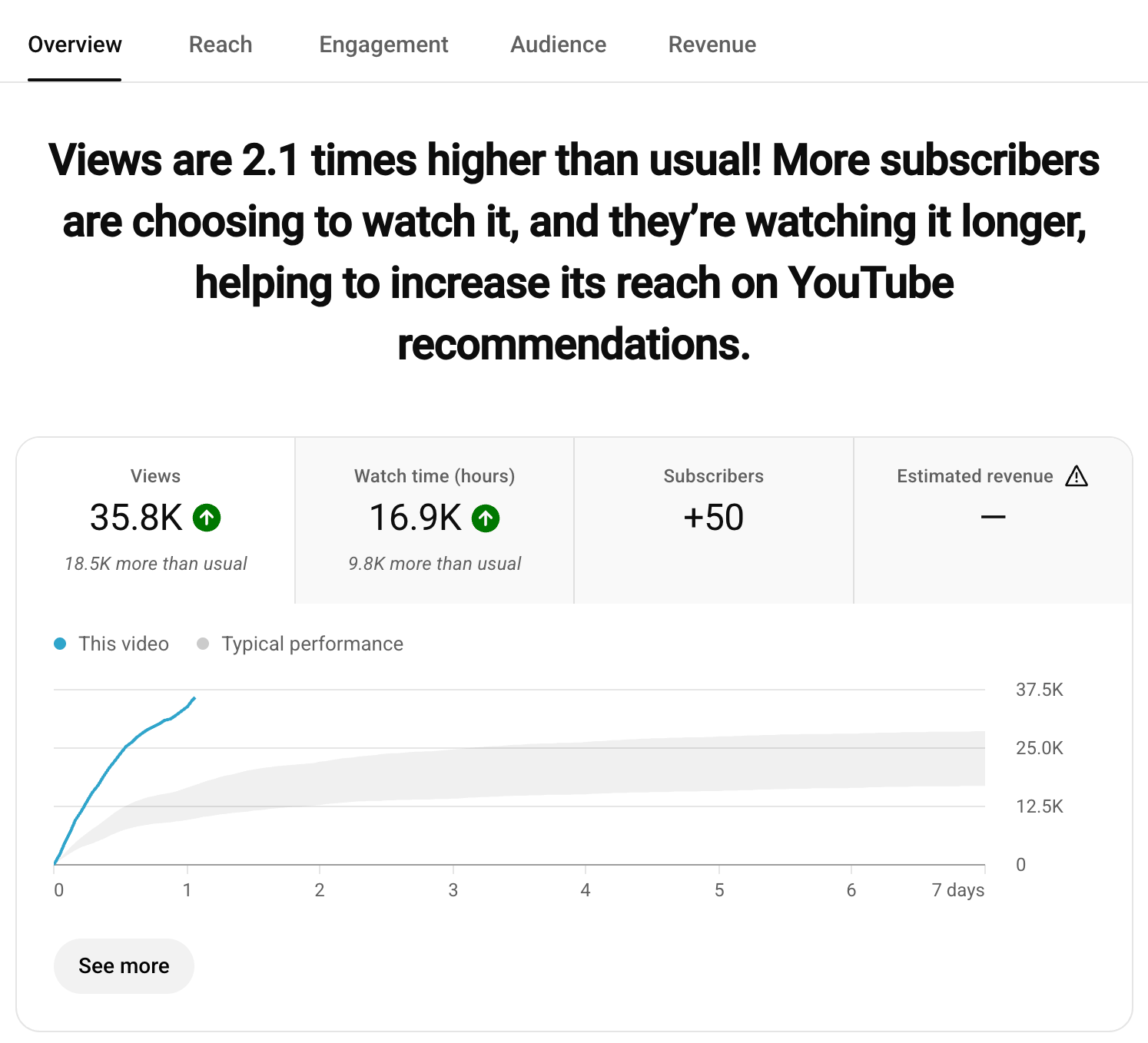

I’ve been on The Street for almost three decades and in all my time meeting a thousand thousand people from every corner of the business, I can tell you with certainty that there’s no one as simultaneously enlightening and entertaining as my boy JC. Whenever he joins us on TCAF, the views and downloads go crazy. This weekend, they’re running double the typical average.

First 24 hours looking good, you guys are feeling this one:

And with good reason - the show was packed with illumination and laughter. What else could a person possibly want out of their favorite podcast?

We talked about the problems of arrogance and having way to much confidence in the investing business. We did a whole run of charts showing the best themes and trends in the current environment. I pitched some charts of my own to the expert to see what he thought of some of the current Best Stocks in the Market. Lots of other stuff too, you kind of have to listen or watch.

Before I send you over to the show below, I just want to say thanks for all the positive feedback I got for the site / email redesign. I am still working some stuff out but I think we made it more readable regardless of where you’re getting it and that was the most important thing. Font sizes, colors, borders, graphical elements, etc - how do we improve the readers’ experience? I hope you like what we did. Special thanks to the team at Pixels and Ricky Figueroa.

These are the Stocks to Buy in 2026

THE COMPOUND & FRIENDS

These Are the Stocks to Buy In 2026

Michael Batnick and Downtown Josh Brown are joined by TCAF legend JC Parets to discuss: the stocks to watch in 2026, people JC has learned to fade, the sectors looking to break out, the magazine cover indicator, prediction markets, and much more!