A few years ago, before the pandemic, I played the Harbor Links Executive golf course in Port Washington with a friend. We got paired up with a third guy who was there by himself. My friend Matt and I were early forties and he was late fifties. Nice guy, didn’t say much at first.

I don’t really golf in real life so within a hole or two he began giving me pointers. Which I f***ing hate, “mind your business” is what I wanted to say, but he was just being nice. And then we got to talking about our kids. Matt’s son and my son are best friends, and at the time they were in elementary school. The other guy’s kids were grown and working. Both had gone to great colleges, I think one went to University of Michigan and the other might have gone to an Ivy.

The way he spoke about what his sons were doing now - one working in real estate and the other in investment banking - it was as though he built the pyramids in Egypt. The pride in what he had accomplished as a father in guiding his boys toward success and seeing it all the way through - it was almost tangible. The joy in his voice. His whole face lit up. He went from not talking much to not being able to say enough. Not in a boastful way - and this is important - just in such a way that you could tell he achieved the sum total of his life’s ambition. This was the most important thing in the world to him and he undeniably did it.

I still remember this encounter because I was really affected by the way he spoke and how he carried himself having pulled this off. I remember saying to Matt “There’s a guy who really did it. I’d love to feel that way someday.”

Two weeks ago I got a little bit of a taste of it. We found out that my daughter was accepted into the University of Miami. We’ve been working as a family to make this happen for the last seventeen years and now here we are. So much sacrifice and time and energy, so many early morning drives to extra help before school, so many late afternoon pickups and tutors and review sessions. It was a full-household affair and it took the complete devotion of all of us to get her into a position to succeed. She took everything we were willing to give and she ran with it. It all paid off.

I have a daughter who’s off to college - her first choice - and ready to begin her life as an adult. I can’t even describe how it felt when we got the news. I don’t cry, but I had actual tears in my eyes watching her jump up and down with her friends in celebration.

Momentum

I bring this up because I got to watch another special moment like this happen for someone else yesterday. My friend Joe Terranova got to ring the closing bell at the New York Stock Exchange in recognition of his namesake ETF - the Virtus Terranova US Quality Momentum ETF, otherwise known by its ticker symbol, “the JOET” - hitting its third anniversary. His wife and three children were there on the balcony as he rang it and then slammed down the ceremonial gavel at 4pm. He was flanked by his coworkers at Virtus and cheered on by a whole trading floor below comprised of people who’ve known him both professionally and personally throughout his life. I don’t know how he held it together and kept the tears at bay. I would’ve been a ball of mush.

Joe’s dream of building a quantitatively-driven product that plays up his concept of marrying the Quality factor with the Momentum factor became a reality at the end of 2021. Three years later it’s gaining in assets and proving his theory about stock selection.

By combining momentum and quality, the theory goes, you can end up with a portfolio of names that will survive drawdowns while remaining competitive in bull markets. Prior to Joe’s fund launching, the most popular momentum ETF, MTUM, had the lane to itself for the most part.

Before I go any further, let me remind you that I do not recommend funds on this site or give financial advice in blog posts. All standard disclaimers about past performance and all exhortations to read prospectuses apply…

Anyway, MTUM is an iShares product and while it seeks to capture the momentum factor, it’s not always successful and momentum is not always going to be the best factor in all market environments.

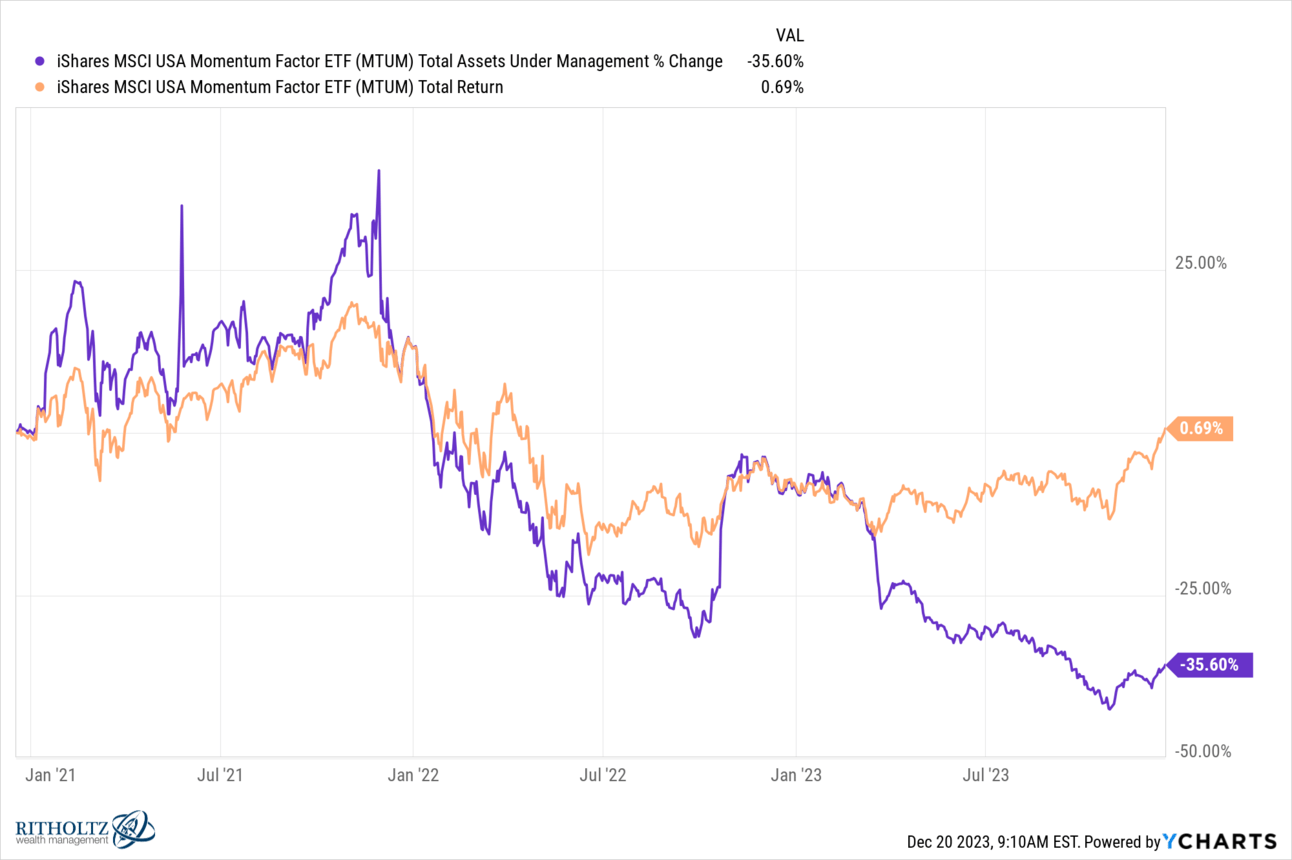

It’s had a rough few years as you can see in the chart below.

The orange line is total return over the last three years. The purple line is the percentage gain (or loss) of assets under management, which has fallen 35% in the period. Since the highs reached at the end of 2021, MTUM’s assets in dollar terms have fallen from over $16 billion to around $8.5 billion.

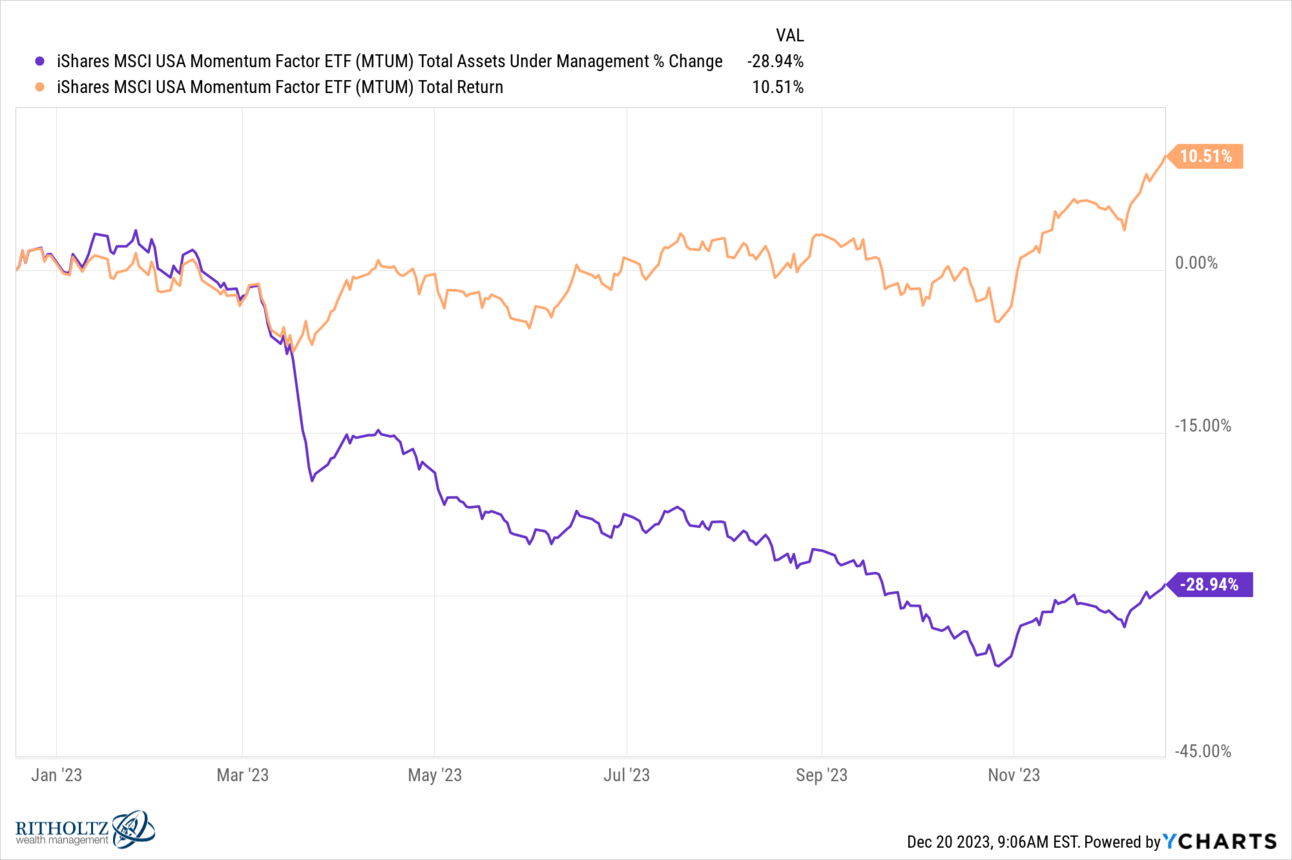

In the chart below, you can see that MTUM’s assets (purple) continued to flow out even as the fund’s returns started to climb back into positive territory:

Investing is a relative game, not an absolute one. Gaining 10% while the Nasdaq is up 50% just isn’t going to attract net positive flows for a product with “momentum” in its name (and in its ticker symbol!).

Of course, I have no idea how the fund will fare in the future, but this is what the experience has been like until now.

I took a look at the JOET ETF just to get a sense of how it had held up during the same time frame. Did the quality screen employed by Virtus make a material difference?

The answer is yes. Big time.

JOET is in orange, MTUM is in purple. Over the last three years, one has consistently separated itself from the other. So why does MTUM have ten times the amount of assets under management as JOET? Here are some reasons I thought of:

It’s been around longer. The iShares MSCI USA Momentum Factor ETF was born on April 16th, 2013, giving it a seven year head start before the debut of the Virtus product and a track record exceeding ten years. This means it’s more useful in model portfolio presentations because the advisor baking it into his or her cake doesn’t have to substitute live performance for hypothetical backtested index performance.

iShares is BlackRock and BlackRock is amazing at marketing funds and keeping its products front of mind for RIAs, hedge funds, family offices and broker-dealers. In most categories, BlackRock has a (or the) default product. It’s not an accident that they became the largest asset management firm on the planet.

Inertia - always an explanation for these sorts of things. Some money is just parked forever and is completely insensitive to alternative products, changes in market behavior, performance, volatility, etc. People set and forget. Not everyone, but a lot of people. Some advisors would prefer to tell clients that the original decision to invest in something was right and that things will eventually work out rather than say “I made a mistake, let’s make a change.” This is human nature.

It’s built into models with sticky money where it’s not important enough to change. This happens too. If you built a factor-driven asset allocation model and “momentum” was just 5% of that model, then who cares. Let it be.

There are believers that the MTUM methodology will prove superior over the very long-term relative to other fund options. Of course this is possible. MTUM could have a banner year in 2024. We won’t know in advance. They have a portfolio construction based on an index and that index could work better than other momentum strategies. It could also be worse. So much of that is timeframe dependent too. Hedge funds are focused on next quarter, not next decade. Maybe they see MTUM sprinting in the current market environment, unencumbered by concerns about the “quality” of the holdings.

Those are just five ideas that would explain the discrepancy in assets between the two funds. If the performance gap persists into the next two years, I think the AUM gap will shrink a lot. In markets and in life, some things just take awhile.

Big Brother

Anyway, I’m biased. You can’t go by me because I have a personal relationship here. Joe is like a big brother to me, I didn’t have one growing up so it’s cool to know what it feels like. We met on the set of the 5 o’clock Fast Money show back in 2011. The network was just launching Scott Wapner’s Fast Money Halftime Report for the 12 noon hour and both Joe and I were cast on it from day one (only the two of us and Stephanie Link remain among the original Halftime cast). Joe showed me the ropes at the network, made introductions for me and generally just looked out. There were some people on the desk who weren’t thrilled with the airtime I was getting and the oxygen I was sucking out of the room. Joe had my back.

Later, as I got to know him off the set, he showed me much more - how to balance work life and family life and combine the two when possible. How to turn business relationships into friendships. How to enjoy the work you’re doing so that it doesn’t always feel like work. How to better your situation when things become too unenjoyable for too long. And when I needed a practice field for my boy’s travel baseball team, he showed me how to get one of those too :)

Joe is the personification of momentum and quality. His career has been on fire ever since I met him and he continues to grow regardless of what happens in the industry or the markets around him. The people he does business with are proud of their association with him. His generosity is legendary. He says no to almost every proposed idea people throw his way, so that when he finally says yes and commits to working on a thing, everyone around him knows it’s a good project and they want to be involved.

Yesterday was a testament to this. You could feel the pride and joy emanating throughout the world’s most famous trading floor all afternoon.

2024 S&P Targets

Last night the new episode of The Compound and Friends went up and I think you’re going to love it.

Our friend Sam Ro (TKer.co) came on to talk about his annual round-up of Wall Street’s outlooks for next year. He’s the best in the biz at covering these notes. We looked at all the S&P 500 targets and economic outlooks from JPMorgan, BMO, Morgan Stanley, etc.

You can listen here:

In the second segment, it’s the audio of me and Michael Batnick on What Are Your Thoughts. We looked at the gold rally and the prospects for mergers and acquisitions in the stock market next year.

Watch it here or listen to the audio above:

Thanks for reading, talk soon - Josh