Advertisement

What Could a Covered-Call ETF Do for You?

Maximize your income potential with the Cullen Enhanced Equity Income ETF. By combining dividend income with options premium, we aim to deliver high income and long-term growth. Invest with confidence – grow your wealth strategically.

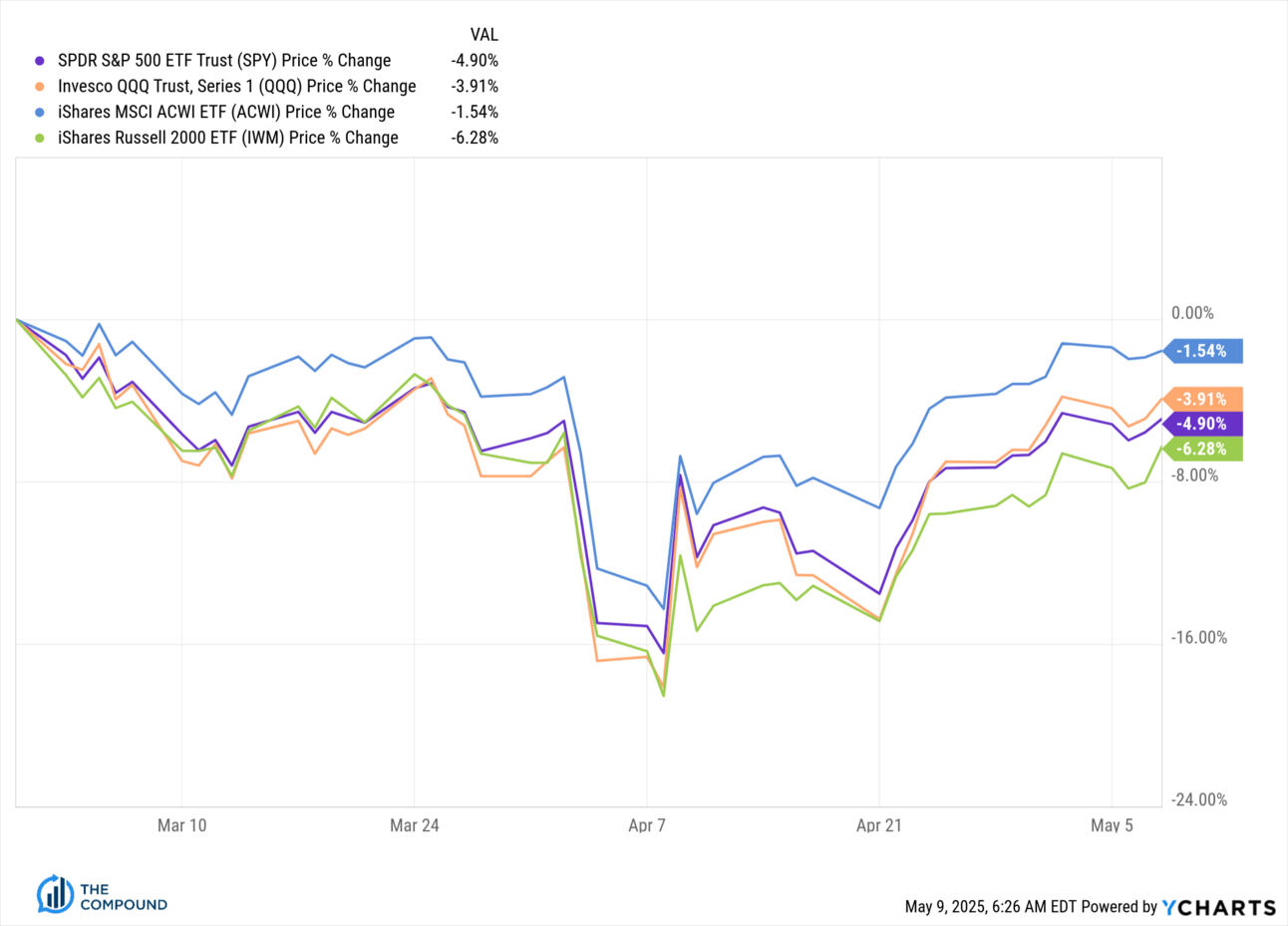

This is the ride we’ve all been on since March 1st in the equity markets:

I’m showing you the S&P 500, the Nasdaq 100, the All Country World Index and the Russell 2000 ETFs. A lightning fast bear market with the S&P 500 in a drawdown of 19% from the February highs. Small caps were the worst and international stocks held up best but directionally it was a sea of red into the beginning of April followed by a furious rally back toward the highs.

What combination of factors produced one of craziest comebacks ever? Well, it wasn’t the Federal Reserve. No riding to the rescue of risk assets this time. Jay Powell told us this week that the big risk was rising prices and slowing growth - the dreaded stagflation - which is what kept them on hold from continuing the rate cuts of 2024.

Below, I list the reasons we’ve made it (almost) all the way back.

Earnings were good

Earnings season bailed out the stock market this spring. There were highlights and lowlights, as always, on an individual company basis, but overall thinks held up for the S&P 500. According to Chart Kid Matt, as of the end of last week actual delivered earnings per share came in at 12.1% year-over-year growth with 77% of all companies reported. I’m not sure what else you’d want to see. That’s damn good, especially considering all of the uncertainty on the macro front. The reports this week continued the trend. The bottom line is that as stocks got cheaper in March and April, the sell-off was not accompanied by a fall in profits.

Analysts estimate that when all these reports are out, Q1 will have been a 12.5% improvement for earnings over Q1 last year. That’s 589 basis points above where expectations were at the start of the season. They see Q1 revenue growth coming in at around 4.9%, also ahead of their estimates going into the quarter. Eight of eleven S&P 500 sectors are posting earnings growth over Q1 2024.

The five-year average earnings per share beat rate is 77% of companies. This quarter 75.3% of companies had beaten their numbers, so right in the ballpark of a normal period.

AI theme intact

Microsoft posted a huge quarter and the stock had one of its best days since the company IPO’d in 1984. That set the tone. Then Meta reaffirmed its spending guidance for AI. Amazon and Alphabet did the same, noting no material change to the demand for cloud computing capacity. This was a major development in the eyes of the bulls, considering how much economic growth is riding on the AI buildout. After everything that’s been thrown at us this spring, it’s still full speed ahead. No one wavered. Even AI chipmaker AMD had a good quarter and that’s saying a lot because AMD is a terrible stock.

Trade-related uncertainty is abating

Do we have a trade deal with China yet? Nope. What about India, Japan, the EU countries, South Korea? What about a re-brokering of the USMCA with Canada and Mexico? No, no, no and no. But we have a deal with the UK as of the middle of this week and a warming of the rhetoric with China. Good enough. Stocks reacted positively to every trade headline this week. The combination of a solid underpinning of Q1 reports and the promise of an end to some of these negotiations was good enough.

As Michael and I talked about last Tuesday on What Are Your Thoughts, the stock market figured out that Trump’s team was capitulating on the absurd tariff percentages from Liberation Day. Stock prices were effectively laughing at the whole process. It’s not really hardball, it’s actually Nerf. Some CEOs removed their formal earnings guidance for the rest of the year but most did not. Technically, we don’t have many deals yet, but the deals are not going to look like the numbers on that poster from the Rose Garden.

Oh, and the carve-outs for tech and chips and the persistent rumors of exceptions for autos didn’t hurt.

Can’t have a recession if no one gets laid off

We got an April Non-Farm Payrolls number in the first week of May that surprised to the upside. That helped too. Yes, consumers are pulling back from certain areas of spending (notably, travel), but there is no evidence of a wholesale retrenchment. The credit card company and bank CEOs told us emphatically it’s not in any of the data they track. Long-term unemployment is ticking up but not to catastrophic levels.

Sentiment fell. Fast.

As Trump began to turn his attention toward trade, the stock market didn’t wait. Way before Liberation Day on April 2nd sentiment was already plunging, ultimately to levels not seen since the Great Financial Crisis. The Vix spike was accompanied by a complete washout in every survey, from the old people who answer landline phone calls to weigh in for AAII to the portfolio managers who answer to Merrill Lynch’s Global Asset Allocation report. It was bad, bad, bad across the board.

Retail investors don’t give a shit

While the chief market strategists on Wall Street were tripping all over themselves in a race to lower their year-end price targets, the Robinhood crowd was doing its usual Leeeerrrrrooooooyyyyy Jenkins maneuver. This has become a recurring feature of the modern stock market. The experts warn us that something terrible is about to happen, like a bank run or a hot war in Europe or an economic collapse and then, because it doesn’t happen within 24 hours, the Millennial and Gen Z investors plow into the stock market, buying ETFs, tech, Bitcoin and anything else that isn’t nailed down. They know their time horizon isn’t the same as it is for the Boomers. This news is for our parents, not us. This is learned behavior and it’s been rewarding. Why would they stop now? All of the data we got from brokerage firms tells us that when the market fell this April, they rushed in to pick up the pieces.

Now, of course, everything I describe simply explains why we got to where we are now. I wish I could tell you that any of it is predictive but, of course, I can’t. Many who remember market history would tell you that this price action reminds them of the year 2000, when one of the greatest bull traps of all time was sprung and everyone got sucked back into stocks in the second inning of the bear market that didn’t end until 2003. If this is another bull trap, it’s an elaborate one. Bulls were pointing to the massive breadth thrust last week and telling us how rare it has been historically to see this many stocks rallying at once without there being index follow-through to the upside.

One of the things that makes market-timing so hard is that at a major crossroads there is data to support both sides and smart people are lining up in direct opposition to each other, all making cogent arguments for higher or lower prices to come. The only way to escape this conundrum is to have a process rather than a forecast, and to remember that your timeline is not the same as those doing the talking.

Muddy Waters

Carson Block of Muddy Waters

This week on The Compound and Friends we hosted legendary activist short-seller Carson Block of the firm Muddy Waters for a unique conversation unlike anything we’ve ever done on the show. It’s so good I don’t even want to preview it. You gotta just devour this thing.

Let’s go Knicks, obviously

Carson’s been involved with some of the most controversial story stocks ever and has unraveled some of the worst financial frauds the market has ever seen. You can watch or listen to our conversation below.

What a conversation!

YouTube:

Podcast audio:

That’s all from me this week. Hope you have an awesome weekend, talk soon - Josh