1 Bloomberg Finance, L.P., as of December 31, 2025. Average 30-day notional dollar trading volume.

Adtrax: 8728336.1.1.AM.RTL SPD004424

Expiration: 1/31/27

SPY: Built for speed in a rapidly evolving market

SPY trades an average of $54.94 billion daily1—more than any other ETF1—so you can tap into unmatched liquidity.

Get in and out of markets fast with SPY, the world’s most traded ETF.1

I know you want to play for a bounce in software…

I do too. Added to Uber, ServiceTitan and Toast this week at 52 week lows in my personal account. Probably too early, we’ll see.

These are long-term investments and companies that I believe ultimately benefit from increased automation and generative AI. Why? Because they have the user base, the network effect and the distribution. So plugging in technologies that lower their costs to deliver services to their customers is an obvious margin benefit. Toast is selling technology solutions to cooks, chefs, restaurant owners, waitresses, sommeliers and bartenders. These are the people who are second-to-least likely to start coding their own software using an LLM and somehow implementing it into their payment systems and reservation management workflows.

The only people who are even less likely to rip out their enterprise software in favor of a homemade replacement are the general contractors, swimming pool diggers, landscapers, gardeners, roofers and plumbers who use ServiceTitan (TTAN) for appointment setting, project tracking and invoicing. In my mind, there’s not a chance that either of these companies is going to suffer from some sort of mass exodus off platform by their respective user base. Once the employees of a Marriott hotel buffet or a tree removal service are trained on a particular app or software product to help the business run, it’s pretty much a lifelong entrenchment. Try to avoid battling with inertia whenever possible.

Here’s Toast’s price versus the forward earnings per share estimates as a trend line.

<Adam Sandler Moron Voice> ORANGE LINE GO UP</Adam Sandler Moron Voice>. Nobody gives a shit right now. Literally no one. I added to my position but I don’t expect any sort of instant gratification.

While I’m extremely confident in the fundamentals of these companies and their dominant market share situations, I can’t say the same about their stock prices. Even if the software bounce from Friday is extended another few days, I wouldn’t be surprised to see these stocks roll right back over again. I am advising people who have a time frame of anything less than one year to stay out of this fight and stop trying to bottom-tick these enterprise software stocks. Some of them have gotten absurdly cheap and some of them have just been disrupted out of existence and we don’t yet know which is which or what the time table might be.

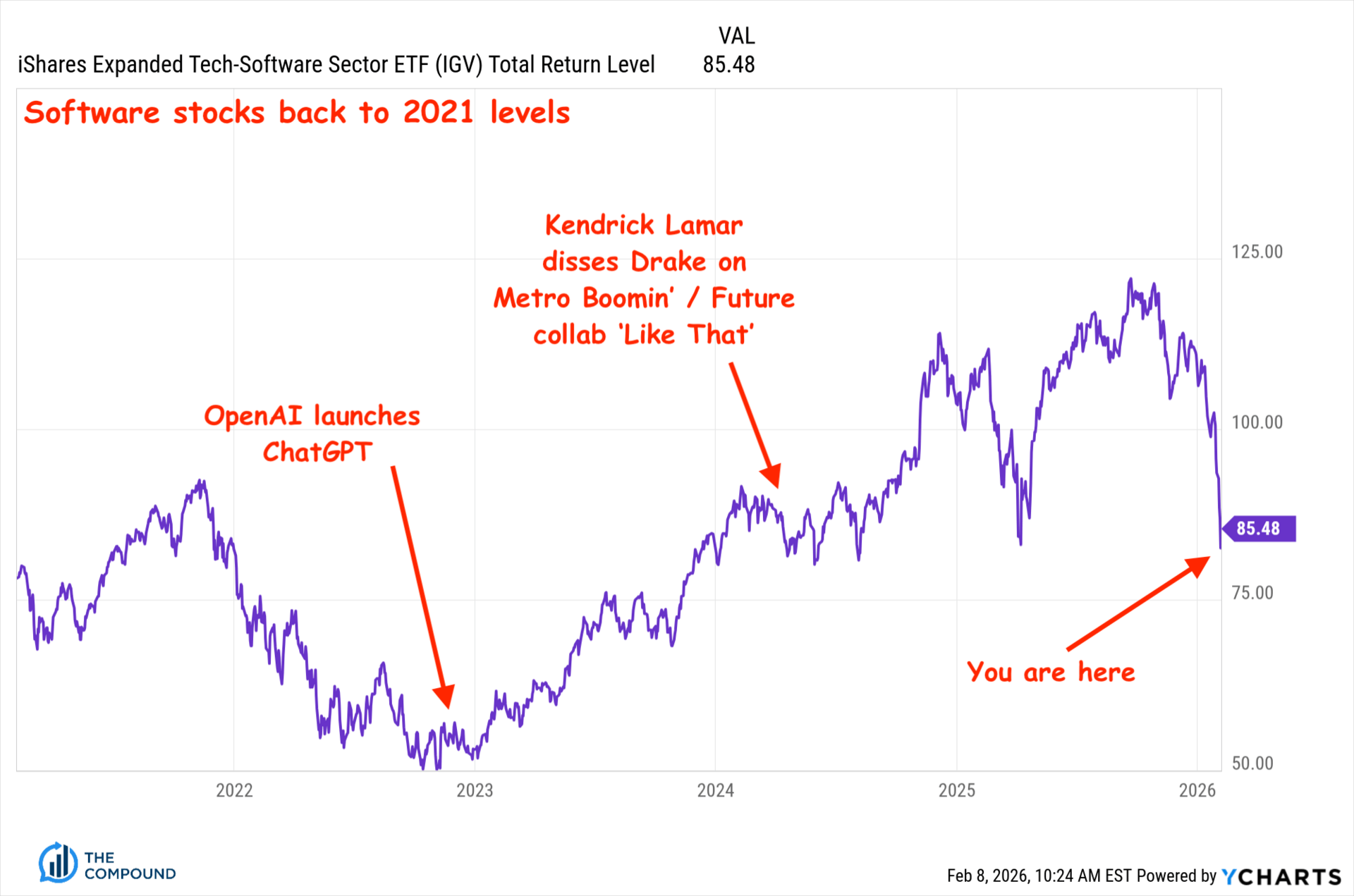

Here’s a look at the IGV, which is the market commentator’s shorthand for what’s happening with the sector:

My colleague on CNBC, Stephanie Link, made a very important point on the air this week - the problem with all these falling knives is that there is no proof point we can look at on the calendar and say “By May 17th it will become apparent that Workday is not disruptable.” It’s just one hundred percent crowd psychology at this point.

Even the fundamentals won’t save these stocks from the multiples re-rating lower. We know this for a fact because they all (almost all) had great earnings reports so far this quarter. It doesn’t matter. Investors are focused on the three-year outlook, not a quarterly screengrab of the last 90-day period - and they are extremely pessimistic about that outlook given the acceleration in AI adoption and innovation. They just don’t think these companies can survive it with their current margins and growth rates intact.

Bounce

We were due for a bounce and we got it on Friday. Below you’re looking at the extreme readings in RSI (a measure of momentum) along with the depth of each stock’s drawdown circa Thursday. Just to give you some perspective, when technicians see a 30 RSI reading they refer to a stock as being oversold. A reading in the 20’s is like if a company suddenly came out and filed for bankruptcy. Now, I’m not cherry-picking - these are the 12 largest companies by market capitalization in the Software ETF. In a normal environment, sellers don’t do this to their holdings or buyers don’t let things get this drastic:

But we’re not in a normal environment. We’re in a vomitorium. And when people are vomiting up every stock in a sector, indiscriminately, you don’t need to be a buyer but you should probably stop being a seller.

Digression, forgive me:

The term Vomitorium is so viscerally evocative that I couldn’t help but use it above - even though I am misusing it, knowingly and deliberately. People who come across the term mistakenly believe it has something to do with digestion or purging one’s gastric system. A popular story is that the ancient Roman nobility kept rooms known as vomitoriums so that they could empty the contents of their stomachs after a lavish meal, returning to the feasting table ready to commence eating again. This plays into popular tropes about all these emperors, praetors and consuls creating ostentatious spectacles of hedonism while their citizens starved. The problem is there was no such room. According to historians the actual purpose of a vomitorium was as a wide egress or entry for large amounts of people to exit or enter a building at once, such as the Coliseum on a crowded circus day. The Romans did a lot of weird and perverted things, but building a room to throw up in was not one of them.

Sorry, back to what I was saying…

But to Stephanie’s observation, when does that pessimism wear off? No one can tell you. It’s all vibes. There’s no way of knowing until we get there. We may see several “false bottoms” along the way. I think you need more people to give up. That sort of capitulation sometimes requires time, not just a plunge in price. It needs rollovers and failed rallies and disillusionment before the seeds can be planted for a new season of growth. And in the absence of a proof point that this is over, observing sentiment (through the lens of price) is literally all we have to go on.

In other stocks and scenarios you often do have a proof point. Sometimes it’s an FDA approval for a drug. Sometimes it’s the announcement that a negatively perceived merger is being called off or an unpopular CEO is being fired. Sometimes it’s iPhone sales data for the month of June or the opening weekend of a new film. Either the bulls were right or the bears were right but, for god’s sake, at least we know. If you’re buying Caterpillar during a twenty percent drop from a 52-week high, you can say to yourself “as long as they have a good earnings report, the sellers will stop selling and the stock will be fine.” That’s a proof point. You’ll either be wrong or be right depending on whether the earnings are good or bad. You can’t say that about Salesforce or ServiceNow.

Earnings reports in the software space - both “good” and “bad” - are only being seen through the lens of “this company is fucked” or “ this company is a beneficiary and will take more business from the AI wave than will be taken from them.” Not surprisingly, as Anthropic and Gemini come out with products at a breakneck pace, more and more software companies find themselves classified into the latter category - the fuck-ees - rather than the former category where you’d want to be - the fuck-ers.

I’m going to tell you that I think any bounce in the software group - not every stock but the sector as a whole - is going to be short-lived and an exercise in frustration. Your fellow investors are not yet done trying to figure out what all this means. Which means the uncertainty may persist for a long time before a new consensus is formed. I could be wrong and there will be exceptions but, in my experience, this is a battlefield worth avoiding until a sustained stabilization in prices. It’s going to be awhile.

So what do you do?

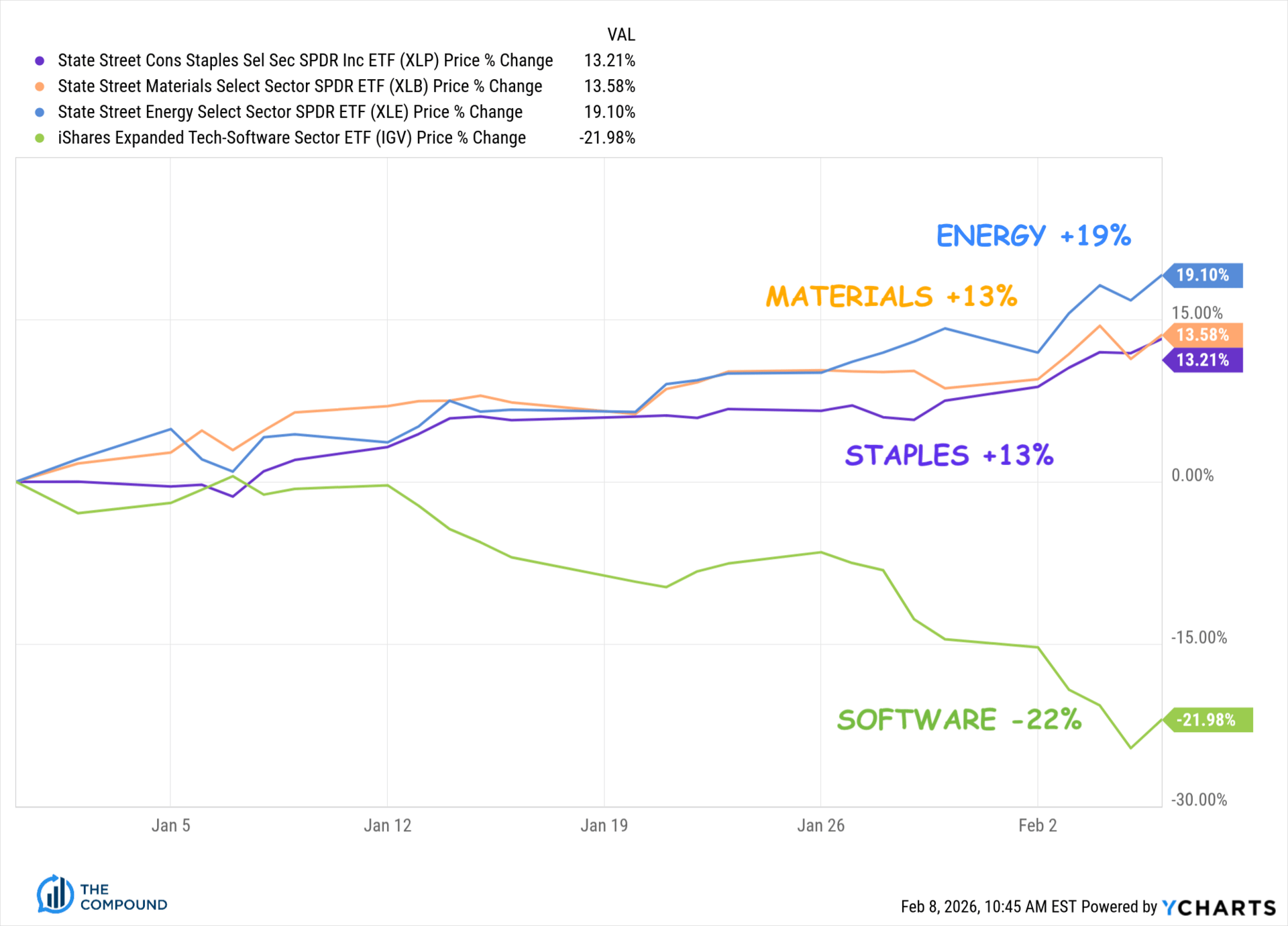

The above shows you the hint that there is a new theme in town. I’m going to get to that in a moment…

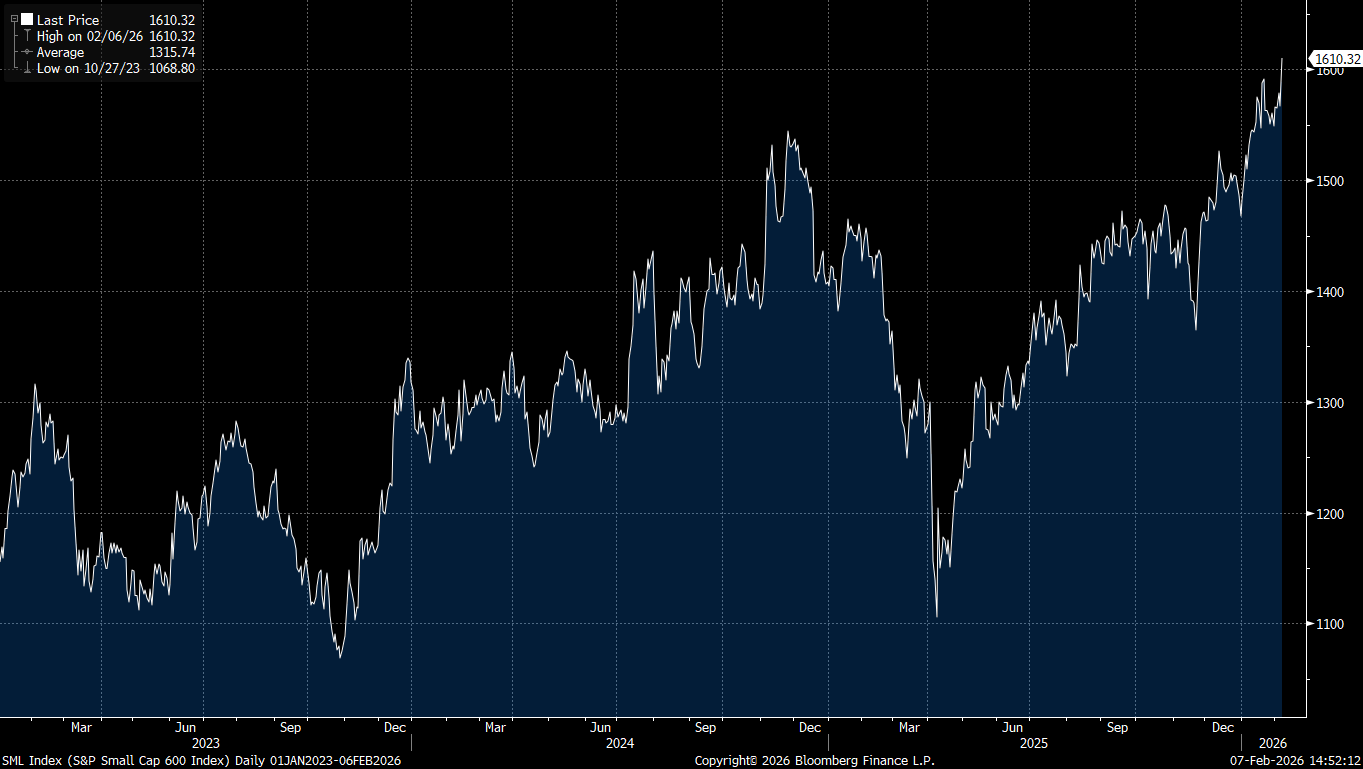

The key thing is that we’re not exactly in a bear market. This past week, Chart Kid Matt, Sean and Michael Batnick were going wild in our little group chat about how well the rest of the market has been enduring some of the most brutal tech stock sell-offs we’ve ever seen.

Some of the charts we’re discussing:

S&P MidCap 400 new highs this week

S&P 600 (small caps with earnings) also new highs this week

Matt: Largest YTD return spread for equal weight minus cap weight back to 1992

Sean: Best five-day stretch for Consumer Staples since Covid

Michael: Where the winners are (and aren’t)

Always a bull market somewhere

There are plenty of stocks still making new highs. They tend to belong to very specific groups, only one of which is obviously tech (semiconductor memory suppliers). The rest of the best performers year to date belong to an entirely different theme. This emerging theme does not currently have a name, which I am going to fix right now. I hereby give you express permission to use it and teach others what it means and why it’s working. Not only is it a backronym, it is also a perfect litmus test for anyone seeking to add a new stock to their portfolio in 2026 (and possibly beyond).

Sorry, me again with another digression, this one will be quick…

A backronym is an acronym which is, itself, an actual word formed out of the letters of the words that make it up. Think M.A.D.D. for Mothers Against Drunk Driving. Okay that one’s not even great because of the extra D but you get the idea.

I’m using the backronym H.A.L.O. to describe the types of stocks that I expect to serve as a winning haven from this year’s feverish pitch of disruption fear. HALO stands for Heavy Assets, Low Obsolescence. These are undistruptable companies from an AI standpoint. There’s nothing Sundar Pichai and Sam Altman can take from them.

HALO stocks are immune to Claude Code. Anytime people are freaking out about Claude Code and ripping capital out of the shares of its perceived gallery of victims, these are the types of stocks that are being bought instead. There will be big HALO days and then ordinary days where it’s hard to see the difference. Thursday was a big HALO day. Friday was not.

So what is a HALO stock in actual practice? Let’s start with a gigantic one…

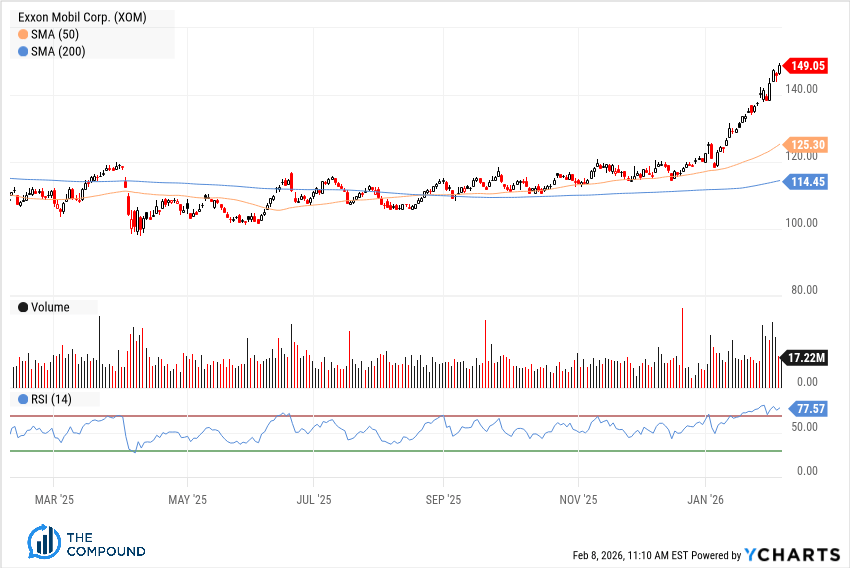

Here’s Exxon, a stock I am miraculously not losing money in since my late fall purchase (praise the Seven):

Sean and I wrote about Exxon for our CNBC Pro column as it broke above this obvious consolidation flatline and it’s gone straight up ever since. Why? Oil prices have done dick. What’s going on? I will tell you:

Exxon Mobil Corp is HALO.

This is not the same as saying Exxon Mobil is risk-free. Of course no stock is without risk. But Exxon does not face this very specific, acutely painful risk of AI disruption that everyone is racing from and bracing for. It’s a mega-cap stock with plenty of room for the trillions of dollars looking for something that’s not going to end up in the crosshairs of DeepSeek or Perplexity. Compared to software disruption risk, the risk of prices moving for a barrel of oil is like a walk in the park these days.

Energy stocks, with a few exceptions, are HALO - Heavy Assets, Low Obsolescence. You get it now? This is the sweet spot of the stock market.

These are the names you can buy and not worry about. They can be thought of as potential beneficiaries of AI given the extensive costs of their existing operations, marketing, service delivery and decision-making processes. Or you don’t even have to go that far - you can just look at them and apply the following simple test: Will chatbots and LLMs lessen or eliminate the need for (blank) in the near future?

If the answer is no, you might have a HALO stock on your hands. If the answer is yes or Maybe, that’s not HALO. Doesn’t mean it can’t work, just makes it complicated for 2026. I am personally focused on HALO stocks only at the moment.

This is an amazing moment, where the entirety of the post-Financial Crisis period is seeing its internal stock market logic being flipped on its head. We spent fifteen years salivating for so-called Asset Light business models with high margins, reliable cash flows and steady revenues. These are the cashflows that Big AI is coming for.

Whether or not a thousand publicly traded software companies will be snuffed out like the Jedi Order after Chancellor Palpatine invoked Order 66 remains to be seen. This doesn’t matter right now. What matters is that the market thinks it’s a possibility. You can have nerves of steel and the patience of a saint to try and fight it. Or you can look elsewhere. HALO is the elsewhere.

Let’s try a few examples, shall we?

Look at the chart above. That’s Walmart (WMT). Walmart is HALO. Almost everything they sell is heavy. They have actual, physical assets like the best logistics network on earth, parking lots, stores, shelves, warehouses, inventory. Automation can only help them do what they do more efficiently and without the tax of so much human labor. In the meanwhile, groceries and tires and furniture and dresses don’t get disrupted in an AI-enabled world. You will still need to get dressed and serve your family dinner once in awhile. Walmart is HALO. Heavy Assets, Low Obsolescence.

Is McDonald’s a HALO stock?

You’re goddamn right it is.

So is Starbucks.

And Valero.

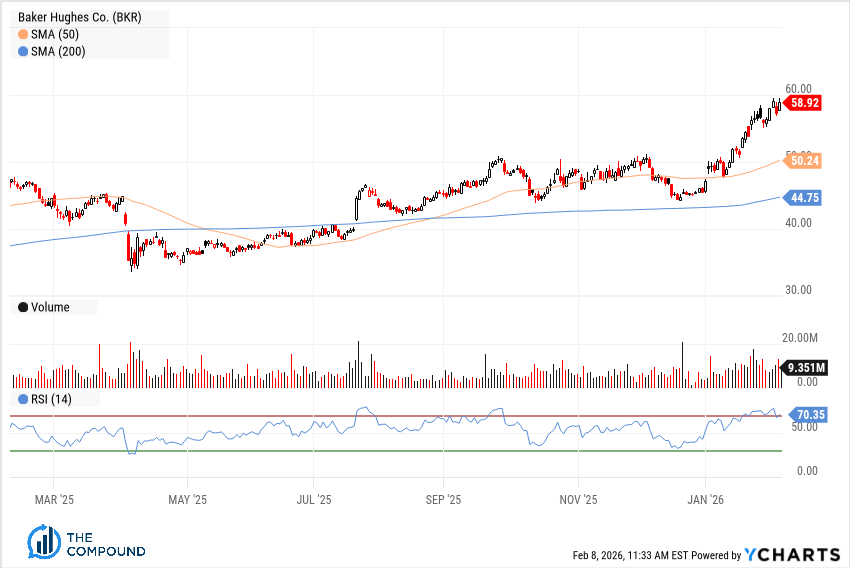

And Baker Hughes.

And Martin Marietta - they make concrete. ChatGPT doesn’t and won’t.

I could go on. I have hundreds of these. Up and to the right. Up and to the right.

If some of these names sound familiar, Sean and I have been spoonfeeding them to you on TV every week, one after another, as part of our Best Stocks in the Market research. You can keep me on mute, I don’t care. Just letting you know what’s been going on.

Anyway, Phillips 66 and Corning and Applied Materials and Vulcan Materials and Delta and Caterpillar and Ventas and Hershey may have very little to do with each other based on conventional GICS classification. But in my classification system, updated for today, they are all HALO. No large language model is going to obviate the need for chocolate, senior living facilities, airplanes, tractors, fiber optics and screen glass, asphalt, etc. These are all Best Stocks based on our criteria and they’re all trending higher. HALO, HALO, HALO, HALO.

John Mowrey on The Compound and Friends

John came to get down

On this week’s all new edition of TCAF we had a guest on whose portfolio has the type of stocks that are working right now in it.

He is John Mowrey of NFJ Investment Group, a boutique asset manager specializing in non-traditional value investing. John made his first appearance on our show (his first podcast, period, it turns out) and absolutely crushed it. We had a blast learning from him and you will too.

they’re just Uggs, relax

You can watch or listen to our conversation with John at the links below.

What to Buy in the Momentum Stock Slaughterhouse

THE COMPOUND & FRIENDS

What to Buy in the Momentum Stock Slaughterhouse

Michael Batnick and Downtown Josh Brown are joined by John Mowrey to discuss: the free fall in software stocks, what makes a value stock, how to measure a bear market, the crypto crash, and much more!