Adtrax: 8559940.1.1.AM.RTL SPD004278

Expiration: 11/30/26

Strength. Scale. Liquidity. All in one trade.

With SPY, you get the full power of the S&P 500® in a single trade—plus unmatched liquidity to help you stay flexible, focused, and ready for what’s next.

Reflation is the term on everyone’s lips

A storm is coming. I spent the last two days getting the house ready for it. Filled up all our cars’ gas tanks. Hit the supermarket, the butcher shop. Bought DuraFlame logs (they were sold out, I got the bootleg brand) for the fire place and some split wood to get us through the nights. I brought a garbage can into the garage in case we can’t access the side of the house. I made a monster batch of my turkey chili and tupperware’d it. Took out the shovels. Been running the faucets and sending water through the pipes. Everyone else around here is doing the same. The stores were ransacked. Lines were long. No eggs left - the entire rack cleared out. It’s like muscle memory from Covid or Hurricane Sandy before it. Sandy knocked out the power to my home for eight days. After day three we were sleeping in front of a fire to avoid freezing to death and just generally living in Mad Max times. I think I had a helmet with horns on it and one of my arms was replaced with a whaling harpoon. Nobody around here wants to take any chances this time. Nor should they. Trust no one or nothing you don’t absolutely have to. Prepare.

A new storm has taken place in the investment world this year. The whole reflation / small cap / transport / metals / emerging markets thing had gotten started last year and this year it’s running away in the lead.

Here’s Tony Pasquariello, managing director and head of global hedge fund coverage at Goldman Sachs, on how the year is shaping up so far in the markets…

they say you should start these notes with a bang. well, three weeks into it, consider this set of YTD returns: gold +14%. silver +37%. TWSE +10%. KOSPI +18%. a basket of European defense stocks +20%. memory stocks +35%. rare earths stocks +50%. 30-year JGB yields +23bps.

…there are a few morals to that story: (1) the trading environment remains remarkably dynamic; (2) some of the most powerful underlying trends of 2025 have gone parabolic in early 2026; (3) in the doing, the reflation trade has slipped into a higher gear. to say it again, every day is its own ecosystem, and there’s certainly no shortage of rock-and-roll.

I know you want the why. Why are these markets in particular doing what they’re doing? It’s not complicated. We’ll take them one by one.

Gold represents global instability and lost faith in the US dollar. It’s working while the existing world order seemingly comes more unglued everyday. The President of the United States is currently involved - verbally and militarily - in conflicts around the world, both real and imagined. Trump wants peace between Russia and Ukraine and there’s no sign of any progress whatsoever. He’s trying. He’s also got a regime change in Venezuela underway and is expecting continued cooperation from the country’s new leadership on getting their domestic energy infrastructure going again - with, of course, the help of several US oil producing corporations. Iran, Gaza, Greenland, maybe Colombia, allegedly Cuba - there’s no telling what’s next. And when world leaders are on edge and unsure of where they stand vis-a-vis the US, you can’t be surprised to see their central banks (and probably their sovereign wealth appendages) accumulating gold as an insurance policy. They’re buying gold every month.

When Russia first invaded Ukraine, we turned their accounts off, seized the assets of their oligarchs around the world and used their dollar-based reserves and the international banking system against them. The lesson, for both Russia and everyone else watching, was that dollars are only a risk-free store of wealth if you’re on the side of the current administration. And if you’re not, you had better be long some other sort of capital reserve. I’m not suggesting this is the only reason for the gold bull market, I’m just telling you it’s the obvious one.

Silver’s rally is an echo of the gold bull market. It usually follows gold and acts as a high-beta shadow on both the way up and the way down - sexier and more volatile, a more extreme expression of the same idea, a toy for traders who prefer the futures market as a beta trade versus playing gold miner equities. The metals and their related equities all go up and down together - silver doesn’t have it’s own story and doesn’t need one. People will say “They need silver for AI! It’s used in old timey photography and transistors!” No. That's not what’s driving it. It’s speculators riding the coattails of gold. The industrial use of silver will not stop people from selling millions of tonnes of it the next time there’s a drop in gold.

But, for now, both are going higher. Speaking of Goldman Sachs, this past week they raised their house outlook for gold by year-end. The new target is $5400 an ounce which implies nearly nine percent higher from here. That doesn’t seem like much of a stretch. Here’s the three year look at S&P’s precious metals index. It’s mostly gold and silver futures with a touch of platinum. They simply will not stop buying these metals:

Some of the other winning trades year-to-date that Tony mentioned…

TWSE is Taiwan and that’s basically Taiwan Semiconductor’s recently reported fabulous earnings outlook doing the heavy lifting. The KOSPI is South Korea, which, uniquely among the world’s country stock markets, is hugely skewed toward technology stocks. Roughly 36% of the South Korean stock market’s total capitalization is in just two semiconductor companies - SK Hynix and Samsung. The broader tech sector in addition to semiconductor stocks is about 40 to 45% of the total. This is the AI trade. Like I said, not complicated. Say hello to the South Korea ETF - if it looks like a chip stock that’s not a coincidence:

The European defense stocks are a revelation. This was an obvious trade last year when the debates over NATO funding and whose responsibility Ukraine’s border defense would be turned into a wave of announcements from European capitals about rearmament and a commitment to their own national security. That obvious trade hasn’t slowed down amidst the Davos discussion about whether or not Trump would be willing to take Greenland from the Danes by force. The Europeans are awake now. Here’s the US-traded ADR for Rheinmetall AG, a German defense contractor and military weapons supplier whose stock price hasn’t moved in decades, til now:

The rally in memory stocks is right back to AI. Here’s SanDisk and Micron, two stocks that have found themselves sitting on top of the biggest supply-demand imbalance in all of Chipdom right now, a great place to be. SanDisk’s story is crazy - it’s the flash memory business that spun out of Western Digital one year ago in February as its own standalone company. The stock price is already up over a thousand percent! Micron, comparably speaking, is a bit of a slouch. It has only quadrupled in the past year.

The rare earths rally is a little bit tech industry demand and a little bit geopolitical pawn - the perfect trade this winter. Look at the MP Materials chart. The stock hits its 200-day moving average just as the year turns over and on January 1st it looks like someone fired a starting gun. This is a $12 billion “pure play” on rare earths minerals based in Las Vegas, NV. The company was only founded recently, in 2017, to take advantage of the relative shortage of sites containing rare earths anywhere outside of China. Their “Mountain Pass” mine is in California and is said to be the only active and significant deposit of these minerals anywhere in America.

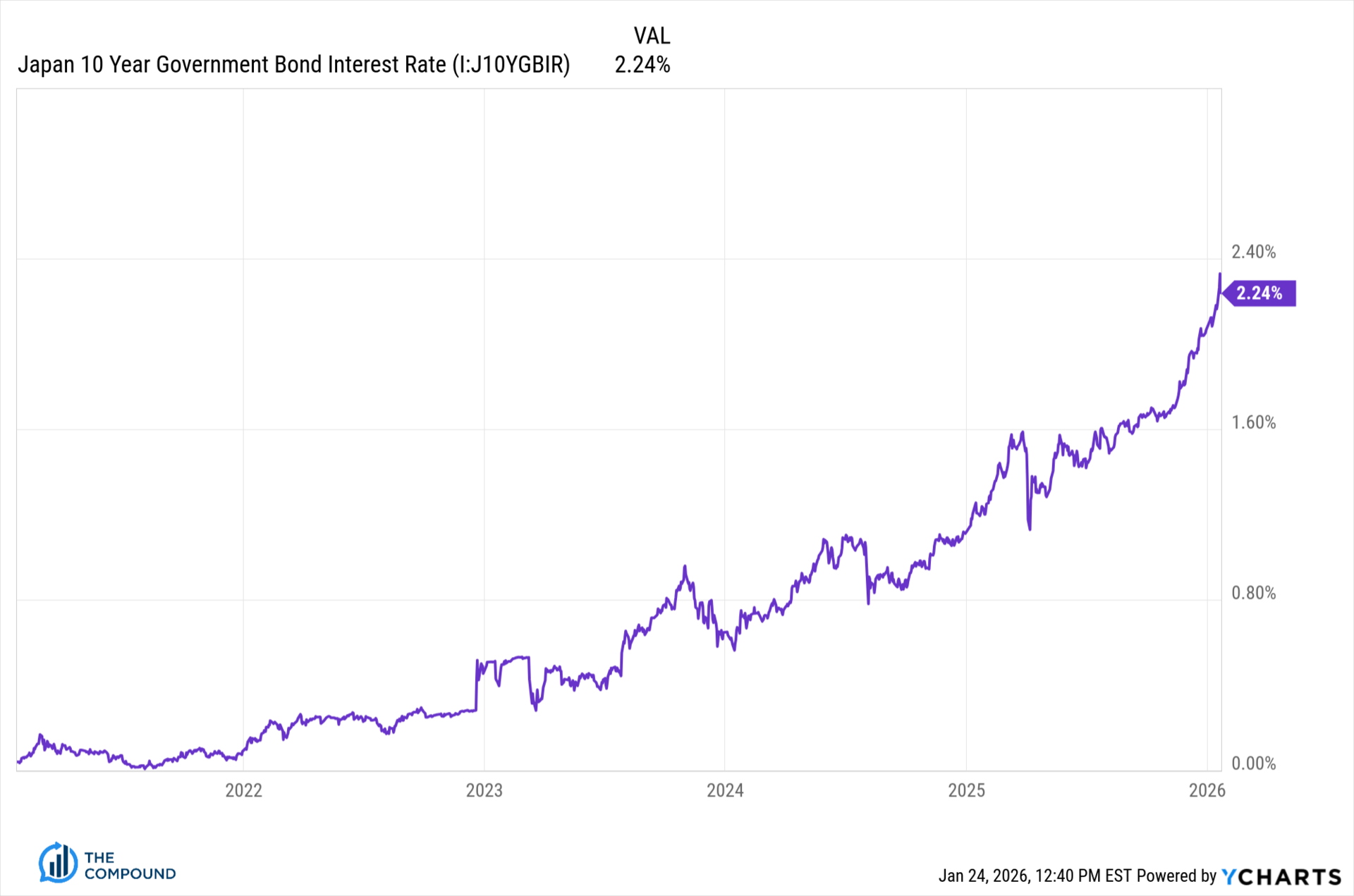

Lastly, Tony mentioned JGB yields shooting up. This is the not-so-bullish story of the year so far. Similar to what happened when Liz Truss proposed a massive, inflammatory spending plan as Prime Minister of the UK and wrecked the gilt market, Japan’s new PM had a bit of a moment. Japan’s bond market got punched in the face by Sanae Takaichi, whose big-spending, tax-cut-heavy plans freaked everyone out and sent JGB yields jumping. The market basically heard “even more debt, no funding plan” and immediately demanded higher yields to hold Japanese bonds. Ake-ome!

This is just the 10-year’s current market price:

The Japan thing got a lot of attention because it’s a prominent example of the government wanting to continue to pile on more debt and spending and then, all of a sudden, the potential buyers say “No.”

My pal Garret Baldwin at Me and the Money Printer summed it up:

on Tuesday, Japan’s bond market imploded.

And yes, that is the right word, given the statistics behind the statement.

US Treasury Secretary Scott Bessent had this to say yesterday: "Markets are going down because Japan's bond market just suffered a six-standard-deviation move in ten-year bonds over the past two days."

That’s not an academic calculation.

It’s a macro trader’s way of saying the models stopped working. That’s statistically an event that should happen roughly once every 1.4 million years.

In Japan, the nation’s 40-year government bond yield surged 40 basis points in two sessions. The 30-year bond hit record highs, and its 20-year auction was so bad that dealers reported pretty much no buyers showed up.

Said a Nomura portfolio manager: “There’s no buyers on the level of the market.”

One of my favorite bull markets of the moment is in the Dow Transports. The cost of moving people and things is higher. This is being driven by demand in a domestic economy that is still - somewhat improbably - better than many have given it credit for.

The charts you’re seeing below are the shippers, expeditors and truckers that are large weights in the IYT transports ETF - please bear in mind this is just three months:

Sean and I have been discussing these transportation names since the summer on TV and in our Best Stocks in the Market write-ups. I don’t think the move is over. The railroads don’t look as good as the truckers, but maybe that’s the next leg higher.

What all these winning trades have in common is that they are part of the reflation trade, part of the AI trade or part of the geopolitical storm trade. And all three of these trades have aspects that are interwoven together - gold and borders and AI competitiveness and supply chains, it’s all sort of one big story where you have to understand these smaller stories in order to keep up.

It feels as though, all at once, every country is doing what it can to get ready - the on-shoring of manufacturing, throwing up of trade barriers, a race to secure steady supplies of chips, large-scale re-arming, gold stockpiling, etc.

There’s a storm coming. You can see it in the markets as plain as day.

Jeremy Grantham on TCAF

The legendary Jeremy Grantham in studio this week

Jeremy Grantham’s first appearance on The Compound and Friends was in the fall of 2023. He gave us a lot to think about and a ton of historical context. In Grantham’s sixty years as a professional money manager, he’s seen quite a lot.

But what he’s seeing right now with AI, he tells us, is something else entirely. It may be a bigger event than anyone alive has ever lived through. Jeremy thinks the societal impact of AI will be unlike anything we’ve seen since the railroad in the 1800’s and the advent of electricity in the early 1900’s. He believes the AI revolution will be even more profound than the birth of the internet.

Michael and I were honored and thrilled to debate ideas with the GMO co-founder and legendary portfolio manager at our New York City headquarters this week. Grantham is celebrating the publication of his new book - The Making of a Permabear - a combination of his life story and everything important he’s learned about navigating the markets, allocating assets amid uncertainty and managing money for other people. The title is meant to be tongue-in-cheek but it’s a bit too subtle according to the author. He wanted “Permabear” in air quotes, as this is how many on The Street and in the media have wrongfully mislabeled him. He hasn’t always been pessimistic, but, admittedly, it’s been awhile since he wasn’t.

with the legend

Jeremy’s co-author, Edward Chancellor, is himself a legendary market historian, having written the all-time classic Devil Take the Hindmost, a History of Financial Speculation. Chancellor was talked into working with Jeremy and has spent thousands of hours on the new book. For those who lived through many of these moments, this is a chance to relive them through the eyes of one of the most respected investors of all time. And if this history is all new to you, Grantham and Chancellor are quite a tandem of tutors to help get you up to speed.

In our new conversation with Jeremy Grantham, we cover everything from the rise (and struggle) of the Magnificent 7 stocks, the profound implications of artificial intelligence, equity market valuations, investor psychology, the business side of investing, the trouble with profit margins, the plight of the working class, the population ice age now being experienced by Asian countries and soon to be felt here in the west and so much more.

the giraffes on his tie is his signature wardrobe move, the suit was made 48 years ago on Saville Row in London. Grantham is lowkey dapper AF

Jeremy believes a storm is coming for us in the form of civilizational upheaval. We do not have the birth rates required to maintain the status quo of our economic growth engine. And even if western nations decided to re-commit to mass immigration, it’s not clear that this would even matter when you consider the decline in birth rates around the world. The decline in working age populations in Japan and China is a taste of what the United States and Europe will someday experience unless something drastically changes. He doesn’t have a clue what that might be. The silver lining is that slower population growth may relieve some of the pressure from our natural resource constraints and the overall environmental impact of humanity. We went deep with him and just barely held on.

We had a blast learning from the old master and I hope you will as well. You can listen or watch the show at the links below!

Stop Ruining My Perfectly Good Bear Market

THE COMPOUND & FRIENDS

Stop Ruining My Perfectly Good Bear Market

Michael Batnick and Downtown Josh Brown are joined by Jeremy Grantham to discuss: stock market bubbles, the ups and downs of managing money, how the wealth divide has grown so wide, the future of clean energy tech, and much more!