Advertisement

Fixed income expertise

Investors often rely on bonds for stability, but the right partner can make a difference.

They sent Kris to talk to me yesterday morning before I had a chance to throw a tantrum. He just barely caught me in time for the meeting. I was livid but persuadable.

For the last several years my colleagues impressed upon me the need to apply for the Barron’s Top 100 RIAs list. I said no every time. We don’t apply to lists. My attitude has always been that if we’re not on an industry list, the list is bullshit. If we’re not nominated, the awards are fake. If we’re not invited to the summit, it definitely is not and cannot be an actual summit. It’s sort of my schtick but it also happens to be true. We don’t need validation from a magazine that what we’re doing is special and industry-leading. It’s obvious to anyone who has eyes and ears and knows what they’re talking about.

Jay, Kris, Michael - they see it differently. “We have advisors who are killing themselves to help us build this firm,” they explained. Being on a list - not just any list but the single most prestigious and legit list at Barron’s - it matters to them. They would like to show it to our clients. It’s something they’d be proud of. It’s social proof that the work they’re doing is being recognized, not just by clients but within the industry.

I cracked a little. An opening. “Fine. For the advisors. But I want everyone to remember I was against this and I don’t care about it. None of these firms is in our lane, we are a one of one, the whole idea of wanting to be compared to them makes me sick.”

“We got it Josh, you’re too cool. Everyone knows. You don’t care about it. Noted.”

So they planned to apply, with my de minimus blessing. Barry even flew out to a Barron’s financial advisor event to appear on stage with Ron Carson, Steve Lockshin and Ron Carson’s dog. Super prestigious. During the Q&A, the dog explained its transcendental meditation routine.

I’m a fido-ciary!

And then the list came out last September and we weren’t on it. After all that discussion and cajoling and persuasion, nobody here bothered to fill out the paperwork and submit the data. The only thing worse than being on a list where you don’t appreciate the comparison is to attempt and fail to be on that list.

My friends, I almost burst a blood vessel. I was apoplectic:

WE ARE PETER LUGER’S! DOES PETER LUGER’S WANT TO BE ON A LIST WITH THE OUTBACK STEAKHOUSE AND CARL’S JR? DOES PETER LUGER’S CONSIDER ITS DINING EXPERIENCE AND CUISINE TO BE WORTHY OF COMPARISON TO THE F@#$ING CALIFORNIA PIZZA KITCHEN?!? WHY ARE WE DOING THIS BULLSHIT? WHAT CAN WE POSSIBLY HAVE TO GAIN FROM APPEARING ALONGSIDE AGGREGATED PLATFORM SLOP FIRMS WITH “DOING BUSINESS AS” THREE RING CIRCUSES, HIGHEST-BIDDER ADVISOR HIRING PRACTICES AND PRIVATE EQUITY-BACKED, ROLL-UP MEDIOCRITY? HOW DARE THEY. HOW DARE YOU!

I’d repeat more of it but it would make me look even more bratty and insane than I already do. President Jay almost had to wrestle me to the ground. I never said I wanted to be the biggest firm, just the best. It’s all I care about. Sometimes to the point of psychosis. These lists tend to celebrate bigness, not greatness. Hence my reaction.

I was cool within a day or so. Never want to be on any of these stupid lists anyway. They did us a favor. I got over it.

So then some time went by and my guys started with this thing all over again for 2025. “Forget what happened last year, this year it’s going to be great, we’ll be on the list and everyone will be happy.”

“Fine, but I have one condition - I never want to hear a single word about it ever again. Do the paperwork, submit the data, whatever, just leave me out of it.”

“Okay, we got it. Thanks.”

By now you’re probably saying Wow, Josh seems really annoying to deal with. But I swear, I’m not usually like this. It’s just about this one thing. I’m completely irrational about people telling me there is any comparison in the world to what we’re doing. It triggers me. I am fully aware of it and I still can’t help myself.

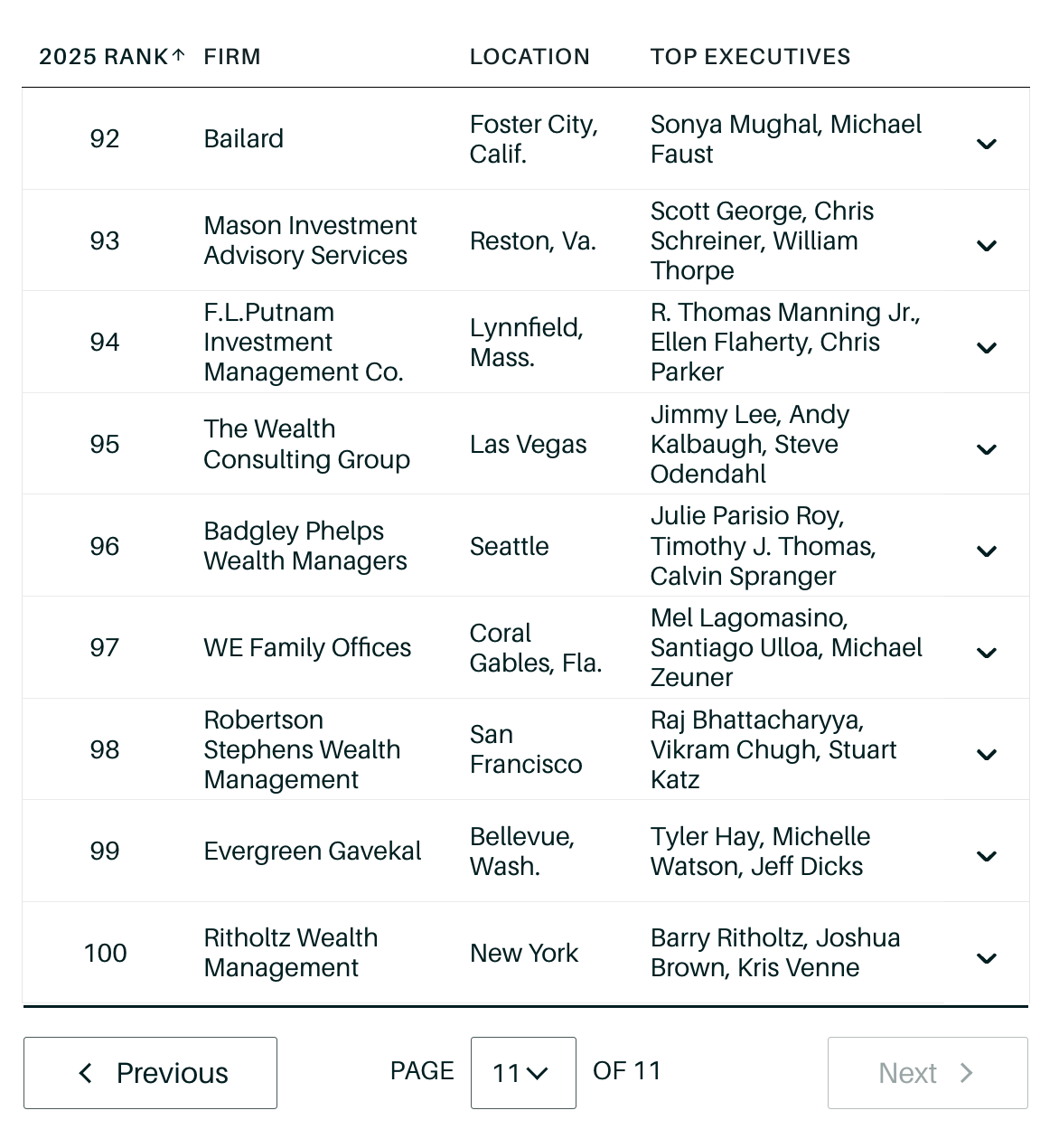

So they sent Kris yesterday to make sure I didn’t go into my firm-wide Monday meeting and ruin it for everyone. Because this year, for the first time, Ritholtz Wealth Management made the Top 100 RIAs list at Barron’s.

And I’m not going to pretend it’s not a good thing. It is. I’ve been a subscriber to the magazine since 1998, almost thirty years. I was reading columns by Alan Abelson, Kopin Tan and a young Michael Santoli since before I even had a single client in this business. So as much as I reject the idea that anyone deserves to appear on the same list as us, I have to admit the fact that it’s Barron’s does make it matter to me. And there are many firms on the list that I do respect and admire. Not all of them, but enough of them.

Now, God (and Jack Otter) still has his sense of humor, because they made us number 100 out of 100, which my partners probably saw over the weekend and began loading up the tranquilizer darts for me. Obviously, being ranked 100 out of 100 is a joke but it’s fine. “If we play our cards right, maybe next year we’ll move up to 99.” Very funny guys. This is the part I was livid about. There’s a methodology here, for the record, but come on. 100? We’re the worst of the best? Why?

😂😂😂😂😂😂😂😂😂😂😂😂😂😂

So Jay talked me off the ledge once again (he’s really good at this and I get really unhinged about it). He asked me some rhetorical questions:

Josh, how many firms start out on the list at number 50 or 70 or 80? Probably very few. Have to start somewhere.

How many firms on the list are still run by the founding partners?

How many firms on the list are only twelve years old versus having been founded decades ago?

How many firms on this list started from scratch rather than as a multi-billion practice breaking away from a wirehouse?

How many firms on this list are 100% employee-owned with no outside shareholders on their cap tables and zero people to answer to other than their own clients and staff? One? None? Can’t be many.

How many firms on this list are growing organically without paying referral fees to rent Charles Schwab’s clients and without acquiring other firms just for their assets under management?

Jay’s point is that while we might be number 100 out of 100 overall, on a lot of these more important metrics we’re top 1, 5 or 10. More importantly, everybody knows it, whether we get an award or a list slot or not.

I thought about it. We could borrow $20 million with one phone call and start buying up average or below-average firms, importing average or below-average advisors and stacking up AUM. We have a hundred offers from all over the world to back us if that’s the route we wanted to take. It’s just not appealing. I might think differently if I had a private equity fund or outside shareholder breathing down my neck every quarter for growth updates, but I don’t.

Literally anyone with a lawyer and a banker can (and will) run in this race to scale. It’s not that hard to give people money. What we’re doing is the hard thing. We’re not winning auctions to buy advisors or acquire AUM, we’re winning hearts and minds. We’re definitely not ranked number 100 on that front. No one will give us an award for it, officially. No one will formally recognize it. It’ll just have to be our own point of pride. And in the long run, we’ll be better off.

Sometimes it’s not what you do but how you did it that ends up mattering.

Someone else can have the trophies. We’re going to have Ritholtz Wealth Management.

Disclosure:

Barron’s ranked Ritholtz Wealth Management (RWM) #100 in their 2025 "Barron’s Top RIA Firms" in September, 2025. The annual ranking is based on data compiled for RWM's registered investment adviser and was based on June 30th data, including annual figures for the previous three years. No fee was paid for participation in the ranking. The ranking is based on firm surveys, and filings with the regulatory databases were used to cross-check the data provided. The rankings are based on assets managed by the firms, growth, technology spending, staff diversity, succession planning, and other metrics. The formula Barron’s uses to rank firms is proprietary. The formula features three major categories of calculations: (1) Assets (2) Revenue (3) Quality of practice. The number of firms included in the 2025 ranking was 100. For the first time, Barron’s is ranking the largest registered investment advisor firms separately from its broader RIA ranking. For our list of mega RIAs, we selected firms that manage 2% or more of the total assets of all ranking applicants. This year, that creates a threshold of $70 billion in assets. For additional information, visit https://www.barrons.com/articles/barrons-methodology-for-ranking-financial-advisors-51615843316. The ranking does not indicate future performance, and there is no guarantee of future success.