Advertisement

Pioneering Access to Institutional Private Markets for Individual Investors

CION is a leading open-source provider of private market investment products. We furnish financial advisors and individual investors with solutions, education and service to help them build diversified portfolios as they seek to maximize risk-adjusted return.

Learn more about private market investing

Breakouts are the stock market yelling at you

In my solo recurring segment on CNBC’s The Halftime Report, I talk about the category of names that Sean Russo and I refer to as The Best Stocks in the Market. There’s a host of hurdles every stock has to get through fundamentally and technically to even qualify for our list and then they have to stay on based upon a different criteria. The entryway is not the same as the exit. And when one of these Best Stocks is setting up for a technical breakout, I do my best to give you the head’s up. We’re having a lot of fun keeping the list, monitoring what’s happening with it and writing about for CNBC Pro.

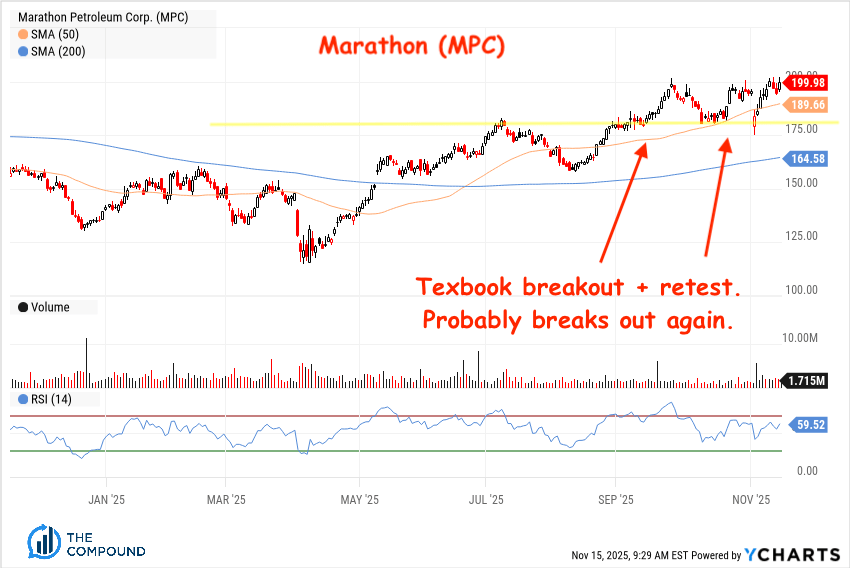

One of the running topics we’ve covered this year is the relative outperformance of the refiner stocks, which have been on the list for awhile now. I bought Phillips 66 (PSX) personally as it was the laggard of the group with an activist hedge fund already involved. But the lesson I want to talk about today is that when a sub-industry group like this one has all of the biggest components moving higher together, breaking 52-week highs, the right thing to do is shut up and buy. Don’t talk yourself out of it (“Oh, I missed out, it’s over”), don’t wait until you have perfect clarity behind the story that’s driving it. I pull the trigger, arrange my downside protection and then try to learn more subsequently. I just shut up and buy.

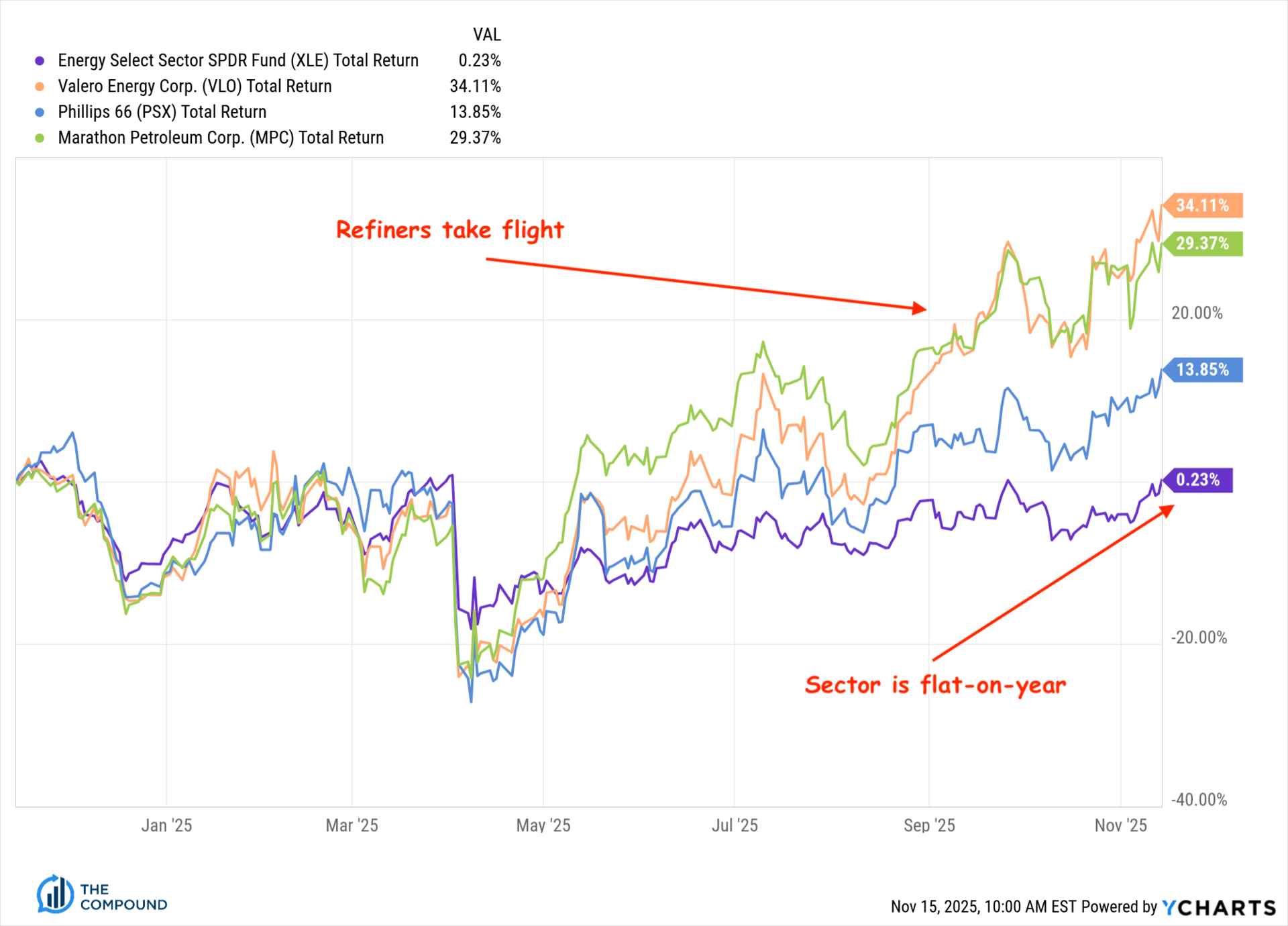

All three of the largest stocks in the “Oil & Gas - Refining & Marketing” sub-industry group within the industry group known as “Oil, Gas, Consumable Fuels” which is nestled within the Energy sector, Russian doll-style, began breaking out this fall.

bucking the trend

This price action was particularly notable as it began in contradistinction to the broader universe of their peers within the energy space. It demanded our attention. We wrote it up. It continued. Oil prices kept languishing so it definitely wasn’t a sector-wide phenomenon. These stocks kept working despite the relative unpopularity of the XLE.

We kept talking about it. Breakout, breakout, breakout, one after another…

Un…

…Deux…

…Trois!

The answer to “why are they going up” will only be obvious in hindsight. If you believe, as I do, that there is a wisdom in crowds, then this would already make sense. If you can be humble enough to accept that the crowd often knows things before you do, this approach is wholly in keeping with the Tao of Rational Investing. If, on the other hand, your default setting is “I know more than everyone,” this is not the right approach for you.

I understand that “shut up and buy” flies in the face of what you learned in school. The people who taught you about “securities” in school have mostly never invested professionally. They’ve never traded large sums of money. They’ve never answered to investor clients. They repeat what they’ve read in books. They don’t know better. Some of my best investments of all time have been in names I only truly became knowledgeable about as we were already mid-flight.

I get that this will upset people, even if they know deep down that what I am saying is true. Especially if they know deep down. And they do. They just wish it weren’t so. We all want to live in a world where the person who works the hardest on research and homework wins and the people utilizing shortcuts or jumping on bandwagons come in third place, but this isn’t a movie or a coming of age novel. It’s the real world and in the real world, sometimes you must stop thinking and start taking action. Technical analysis is not about obeying random lines on charts to the exclusion of all other information. It’s about accepting the fact that you’re not always going to be the first person to pick up on a fundamental change or a sentiment shift - and, more to the point, being okay with that.

Oh, and if you still need the answer to “why?” - which will only have become obvious after the money’s been made - there’s always one waiting for you. In the case of the refiners, it’s an increase in the crack spread brought about by firm demand for gasoline and other refined products and distillates but strained supply due to capacity outages and facility closures. There’s more to the story, but it’s almost beside the point.

As always, if you’re ready to talk to us about our portfolios and asset management strategies, we’re standing by. Connect here.

Joe Terranova live on The Compound and Friends

My pal Joe Terranova joined Michael and I this week at the Paramount Club in Midtown Manhattan for a live recording of TCAF before an audience of over one hundred of the finest financial advisors in New York City.

This guy….am I right?

The question on everyone’s mind is whether or not we should take the sell-offs in Oracle, Meta and Palantir as evidence that investor enthusiasm for AI is waning. Joe updates us on the midterm election cycle stock market data (21 of 21 for the bulls), why momentum is still the dominant investing factor of the year, the secret to outperforming in drawdowns and more.

Thanks to Virtus for hosting this event on Thursday

All the links you need to watch or listen below.

Quality in the Streets, Momentum in the Sheets

Thanks for reading and watching. Hope you have an amazing weekend. Talk soon! - JB