The Ick

AI-generated content gives me the ick…

I can always tell when I’m seeing a video that’s been created by AI or reading a paragraph in an article that’s been authored by it. I know it’s AI because I have an instant revulsion to it, almost like an allergic reaction or a mental gag reflex. It’s hard to describe. It’s what the Gen Z girls refer to as “the ick” and it’s real. I click away as soon as I know. And I know quick. I can see it in things I click on, I can see it on social media feeds, I can see it in my email inbox. And it’s an instant “f*** this” - I won’t read or watch any of it.

Will I always feel that way? Will my whole generation feel that way while subsequent generations feel less that way until the majority of the population just gets used to it? Will the AI ever get good enough to consistently fool me? Will I get over it, either way, because life goes on and there’s plenty of other things to focus on? Will I someday sit through an entire AI-generated movie where the direction is AI, the writing is AI, all the performances are given by AI actors, the stunts are AI, the backgrounds are AI, AI wrote the music, AI edited the film, etc?

I don’t have the answers to any of these questions. But I do know this: I am on ChatGPT, Claude and Gemini all day long. I’m replacing it with search in nine out of ten cases. It’s better than search because it serves me the answer rather than sending me on a treasure hunt filled with blue links that may (or may not) have the answer. It collaborates with me on recipes I’m attempting, helps me adjust for ingredients I don’t have, customizes for a specific serving amount, improves my technique and looks at my in-progress pics to offer assistance on the fly. It answers my questions instantly (not always correctly, how human of it) about every subject under the sun. I probably prompt it with questions or commands hundreds of times per day for just $20 a month. What an amazing thing.

So why am I so grossed out by its creative output? If it’s so useful and practical, why can’t it also be my favorite writer, composer, painter, producer, performer?

I think I know why. It’s because it feels like a trick. Art, for most of us, is connected to the feelings the artist is experiencing and the experiences the artist is responding to. You can’t manufacture that with an algorithm. You can mimic it. But if you’re an artist yourself or a person who deeply appreciates art (not everyone, I know), then the moment you see the AI trying to pull the trick, it makes you want to turn away. Ick.

Anyway, that’s what I think. We’ll see if I still feel that way in six months or six years. Maybe I’ll get over it.

Someone DM’d me a 30 second video clip of an AI-simulated famous actor walking through studio backlots to briefly pose for photos with his old castmates from decades of movies he’d made. The verisimilitude of him and the other simulated celebrities was pretty perfect. And the idea was clever enough to have spawned hundreds of other versions (I don’t actually know which one was the original). I admired the cleverness of the idea and the perfection of the execution. They’re all well done. For example, here’s Marty McFly visiting the sets of other movies, taking selfies with the main characters.

Not terrible. And someone had to come up with the ideas so it’s not totally devoid of human involvement. It just feels…not human. Maybe they’re too well executed?

I didn’t send this to any of my friends (which is what the person posting it wants) because it felt meaningless. I was about to and then I thought “What’s the point of sharing something so fake and empty?”

Then I pictured someone retorting back “What about a Pixar film from Disney? The characters are computer-generated too. Isn’t that also fake and empty?”

No, it’s not.

“What’s the difference"?”

I don’t know precisely how I’d phrase the difference. I just know it is different and that this difference is important.

Living in the Analog World

I made the Wall Street Journal today in a new feature article about the hottest investment theme in the stock market this year - the HALO trade.

I made this term up for you guys a couple of weeks back (you can read it here) and it has already become a thing. The media is writing about it, other bloggers and substackers are too, it’s all over social media, even the big brokerage firms are including it in their research notes.

Here’s JPMorgan:

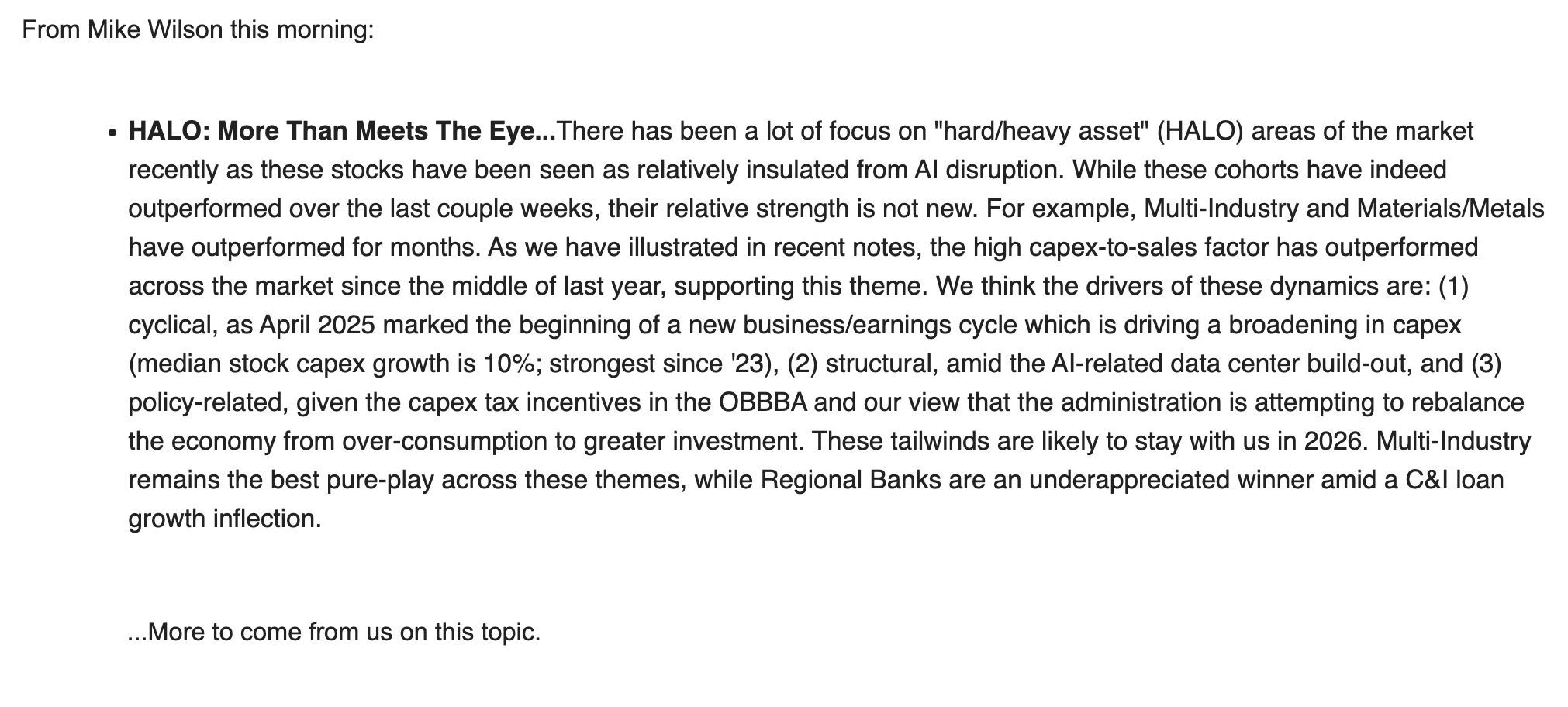

Here’s Morgan Stanley strategist Mike Wilson:

Here’s Barron’s quoting me the other day on the idea:

Josh Brown, CEO of Ritholtz Wealth Management, calls them HALO stocks, a term he said reflects their AI immunity: Heavy Assets, Low Obsolescence.

“You keep hearing people talk about rotation, and investors going from growth to value, but that doesn’t reflect what’s actually happening here,” he said on a recent episode of his The Compound and Friends podcast. “HALO stocks could be either or both.”

“HALO stocks obey a very simple litmus test: can an LLM replicate what this company makes or sells or can it not?,” he said. “People are looking at their holdings and saying ‘is Anthropic about to end this company’s life.’ And if you an answer ‘no,’ that’s where money is being allocated.”

Anyway, in today’s story, reporter Hannah Lang takes a closer look at the stocks that are working this year in the context of my HALO idea and explores whether investors are taking it too far. I told her that of course they will. On Wall Street, no one ever says “okay, enough is enough.” The mentality is always “if a little bit is good then a lot is better. And if a lot is better then way more is great!” Usually, people have to lose a lot of money before this wears off. And then it starts all over again in some other pocket of the markets.

For right now, the stocks of companies that inhabit the physical world - trucks, semiconductors, agriculture and construction equipment, chocolate, coffee, senior living facilities, medical offices, houses - these are the place to be while the disruption question hangs over the asset-light world of software and services.

Analog products, analog assets, analog places. Put another way, so far this year you want atoms, not bits. Will there be swings back in the other direction? Yes. Counter-trend rallies as things get carried too far? Yes. Rotations out of the blue that shake everyone up? Of course. But this is the major trend.

I’m telling you this because I don’t want you to get the impression that I think you need to run out and buy a whole portfolio of industrials and staples. It’s working now but it will, of course, be taken to a ridiculous place by the time we’re done. Don’t do ridiculous things just because other people are. At my firm, we preach and deliver on diversification. It’s why we’ve lasted so long and how we grow the firm every year. Because we protect investors from chasing themes - we’re not running away to join the circus with them.

You can read the Journal’s story with my quotes here:

If we can help you with your portfolio or financial plan, the place to let us know what’s going on is right here. Ritholtz has over thirty financial planners across the country standing by to show you why new clients are flocking to the firm every day. Talk to me.

Michael Batnick handled the hosting responsibilities on this weekend’s The Compound and Friends and it was an incredible episode. Robin Grew and Kristina Hooper of The Man Group, one of the largest (and oldest) hedge funds in the world, came on to discuss all of the biggest questions facing investors today. Without my interruptions and outbursts, the show runs beautifully and they get to so many fascinating facts and insights. I highly recommend you listen, all the links are below…

Looks Like a Bull Market, Feels Like a Crash

THE COMPOUND & FRIENDS

Looks Like a Bull Market, Feels Like a Crash

Michael Batnick is joined by Robyn Grew and Kristina Hooper of Man Group to discuss: the 2026 outlook, AI's impact and recession possibilities, as well as International markets, private credit, and much more!